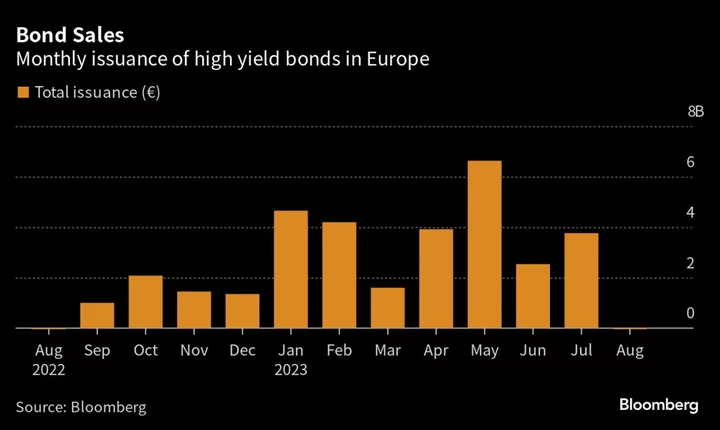

Europe’s high-yield bond market is off to a subdued start in September with the US closed for Labor Day. No new deals have been announced so far, but bankers expect that to change soon, with borrowers still focused on refinancing their existing debt.

The next deal to be announced in the market, when one comes, would be the first for Europe’s junk market in well over a month. Iceland Foods was the last to tap the market, with a £475 million ($600 million) bond which priced on July 26.

Elsewhere, firms in the riskiest tier of junk-rated companies have more debt compared with their income now than they have for at least a decade, according to data compiled by Bloomberg’s Macro View.

While credit quality for those borrowers has deteriorated substantially in the past two years, that has not been reflected in spreads, which remain still well below the historical average compared to debt levels.

Forthcoming Economic Data:

- Thursday: Germany Industrial Production (MoM) (July)

- UK Decision Maker Panel Survey (July)

- Friday: Russia CPI Inflation (YoY) (Aug)

New Sales:

- European high-yield issuance year-to-date stood at €27.4 billion, compared with €20.9 billion for the same period in 2022, data compiled by Bloomberg show

New Performance Review:

High-yield corporate issuers have sold sixty two new syndicated bonds this year.

- Thirty nine that have pricing information available are quoted tighter than launch, according to pricing source BVAL as determined by Bloomberg on September 4 at 09:18 a.m. London time

Fund Flows:

- High-yield funds with a European focus saw outflows of $136 million last week, BofA Global Research analysts wrote, citing EPFR Global data up to August 30

- Global funds recorded inflows of $9 million last week, while US-focused funds saw outflows of $91 million, the analysts wrote

(Corrects currency conversion in second paragraph.)