Federal Reserve policymakers are poised to pause their hiking of interest rates for the first time in 15 months, while retaining a tightening bias that signals a possible resumption of moves as soon as next month.

The rate decision and committee forecasts will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later.

Powell has signaled that Fed leaders would prefer to wait to evaluate the impact of past increases on the economy as well as of recent banking failures on credit conditions. Yet with inflation still more than twice the central bank’s goal, the committee is likely to emphasize it’s keeping open its options to hike again in July or September.

“This will be one of the trickier press conferences for Chair Powell, who I think will be aiming to keep market probability of a July hike reasonably high,” said Dean Maki, chief economist at Point72 and a former Fed researcher.

What Bloomberg Economics Says...

“The Fed will likely keep rates on hold at the June FOMC meeting for the first time since it began this hiking cycle in March 2022. Chairman Jerome Powell and Co. likely will characterize the decision as a “hawkish skip,” maintaining a bias toward hiking at the July meeting.”

— Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church

To read the full note, click here

June Rates

A June surprise is certainly possible. While Wall Street mostly agrees the Fed will pause, Citigroup Inc. economists and those at LH Meyer/Monetary Policy Analytics in Washington are predicting a June hike. Meyer’s firm cites Powell’s emphasis on risk management, with elevated inflation and a too-hot labor market.

The decision comes following the latest report Tuesday on the consumer price index, which showed headline inflation slowed but core prices excluding food and energy continued to rise at a pace that’s likely concerning for Fed officials.

“Inflation is still too high,” said Lindsey Piegza, chief economist at Stifel Nicolaus & Co.. “The Fed opened the door for a pause and to not walk through that door now would cause unnecessary concern. But they are going to have to communicate their work is not done.”

FOMC Forecasts

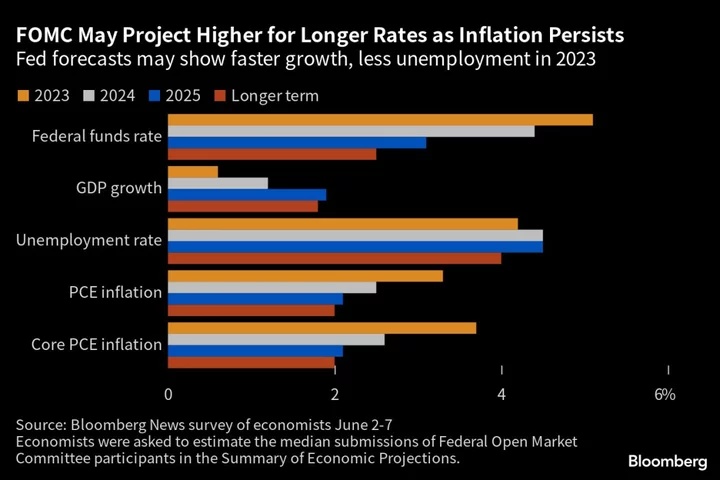

Wall Street will be focused on whether the “dot plot” in the Summary of Economic Projections shows the committee seems determined to hike again.

The central bank is divided between more dovish participants who are ready to stick with the committee’s March forecast of peak rates of 5.1%, and hawks who want to project a higher terminal rate of 5.4% or more. Economists surveyed by Bloomberg expect the median projection will be unchanged.

The committee could raise its forecast for 2023 growth, look for a firmer labor market with less unemployment this year and tweak its inflation forecast higher.

The upshot of the forecasts would be “hawkish compared to market pricing, because they would indicate this is just a skip, not a pause,” said Sonia Meskin, head of US macro at BNY Mellon Investment Management.

FOMC Statement

The bulk of the statement is likely to be nearly identical to the May statement, retaining a hiking bias without a firm commitment. One option would be for the committee to note it is keeping rates unchanged “for now” or “at this meeting,” implying the possibility of a future move.

The statement is likely to continue to describe growth as “modest” and job gains as “robust,” reflecting recent mixed data.

Dissents

About 40% of economists expect a dissent at the meeting, which would be a break from the mostly unified votes by the FOMC. Minneapolis Fed President Neel Kashkari, Dallas Fed President Lorie Logan and Governor Christopher Waller, all of whom are seen as hawks pushing for higher rates, are the most likely to oppose a pause.

A hawkish dissent might reinforce the view that the committee is mulling additional hikes this summer. The last time a governor dissented on monetary policy was Mark Olson in September 2005.

Press Conference

Powell is likely to be pressed to explain why the Fed officials are suggesting future tightening could be needed, but they aren’t moving at this meeting.

“The central tension, if they pause but keep a tightening bias, is: If they’re so sure about the need for tightening in the future then why wasn’t it enough to hike now?” said Derek Tang of LH Meyer/Monetary Policy Analytics.

The chair will be questioned on the outlook for July and September meetings, as well as whether he continues to see a soft landing as likely for the US economy. He’ll also be asked to assess the impact on credit from bank failures in March.

--With assistance from Craig Torres.