Hedge funds extended their record selling streak of short-dated Treasuries amid bets the Federal Reserve’s fight with inflation is far from done.

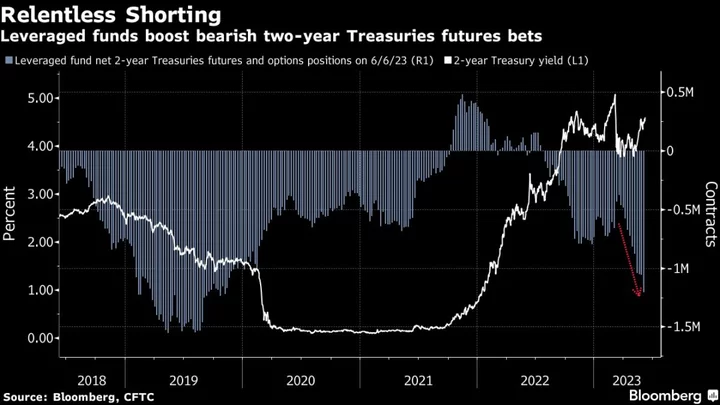

Leveraged investors boosted their net-short two-year Treasury positions for an eleventh straight week in the period to June 6, the latest Commodity Futures Trading Commission figures compiled by Bloomberg showed. That’s the longest run on record according to data going back to 2006.

The positions give a glimpse of fast-money wagers heading into a crucial week, with whether the Federal Reserve will raise interest rates again still up for debate. While aggressive rate hikes have helped reduce price pressures in the US, inflation remains well above target — bolstering the confidence of hedge funds seeking to short Treasuries.

Investors are “signaling that rates will have to hold at a higher level for longer than previously thought,” said Andrew Ticehurst, rates strategist at Nomura Holdings Inc. in Sydney. “Central banks are not yet done: rates are still going to go up a little bit, and we’ve already had a little bit of a scare last week already with the Reserve Bank of Australia and Bank of Canada raising rates unexpectedly.”

On an aggregate basis, hedge funds also added to record net short Treasuries bets in the same period, according to the data. Some of these wagers could also be linked to the so-called “basis trade,” where speculators seek to profit from small differences in the yield between cash Treasuries and corresponding futures.

Yields on two-year US Treasuries — among the most sensitive to monetary policy — were little changed at 4.61% in early Asia Monday. Benchmark 10-year yields held at 3.75% after rising five basis points last week.

That said, some of the world’s biggest bond managers from Fidelity International to Allianz Global Investors, argue the damage from previous rate hikes is done and a US recession may still happen — something which would likely bolster the bond market.

And the hedge fund bearishness also contrasts with some other measures of positioning in the market. The latest Bank of America sentiment survey showed so-called US duration longs at the highest since at least 2004, even as concern about sticky inflation grew.

Swap traders are still expecting the US to cut rates by about a quarter point by year’s end.

Goldman Sachs Group Inc. is among Wall Street banks that say the market impact of any pause by the Fed this week will likely be short-lived.

“Absent a recession, we remain skeptical that the amount of easing currently priced will be realized,” Goldman strategists including Praveen Korapaty wrote in a note. We “continue to believe risks to these forward rates are to the upside.”

(Updates with BofA survey in eighth paragraph)