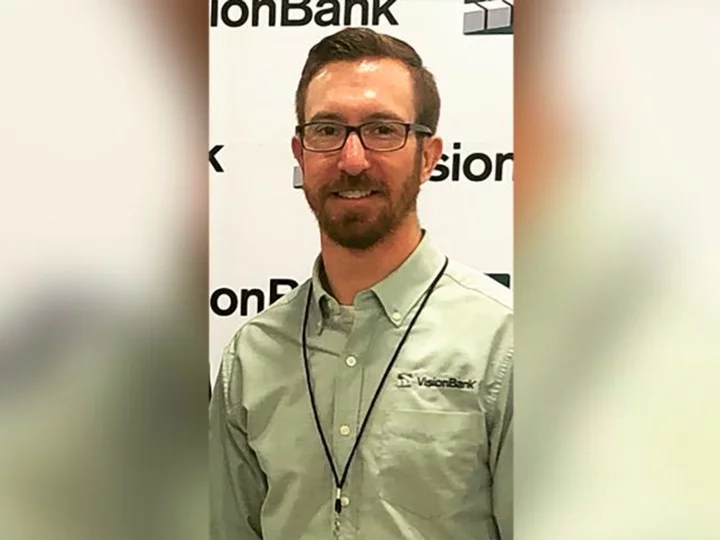

The Federal Reserve on Thursday admonished Tanner Winterhof, a former executive at VisionBank of Iowa, for allegedly falsifying documents, causing the bank to endure major losses. Despite VisionBank terminating him last year, Winterhof still managed to get another job at a bank.

According to the Fed, Winterhof falsified documents, including a subordination agreement, related to loans extended to a customer.

"The documents at issue were central to subsequent bankruptcy proceedings to which the Bank was a party, and the Bank ultimately suffered at least $100,000 in losses and legal fees, in part, by reason of Winterhof's conduct," the Fed said in a formal enforcement action.

Winterhof specifically forged the signature of Melissa Dyer, a loan officer at the Department of Agriculture's Farm Service Agency, on a "subordination agreement," which prioritizes loans by importance, according to a bankruptcy filing VisionBank was listed as a creditor in. The FSA later informed VisionBank that the subordination agreement was falsified.

According to the bankruptcy filing, thea forged signature misspelled Dyer's name.

The central bank said that Winterhof also "directed that a customer's loan proceeds be used in a manner inconsistent with the purpose of the loans as specified in the applicable loan documents," adding that his conduct "involved personal dishonesty and demonstrated a willful or continuing disregard for the Bank's safety and soundness."

Winterhof consented to the Fed order's release and agreed to comply with the Fed. At the same time, he is not required to admit or deny any wrongdoing. But the order, which went into effect on September 26, prohibits Winterhof from being part of any banking institution's leadership.

Winterhof was terminated by VisionBank in January 2022, according to the Fed. VisionBank's CEO Heather Miller told CNN she has "no further comment, beyond what was published by the Federal Reserve, at this time."

He then moved to Availa Bank, also based in Iowa, as a vice president and loan officer, according to the bank's online staff page earlier on Thursday and Winterhof's LinkedIn profile.

However, shortly after CNN reached out to Availa Bank for comment, Winterhof was removed from Availa's staff page. An Availa executive told CNN in an email that Winterhof no longer works at the bank.

"At no time was Availa Bank aware of an investigation against Mr. Winterhof, and any actions taken by the Federal Reserve against Mr. Winterhof are completely unrelated to Availa Bank and its customers," wrote Lisa Irlbeck, marketing director & community education and outreach director at Availa, in a statement.

Winterhof did not respond to multiple requests for comment from CNN beyond an automated out of office email reply. He also deleted his LinkedIn page after CNN began to inquire.

"I know in a strong business relationship the trust runs on both sides of the street and I work hard to develop and maintain the trust of all my clients," Winterhof's LinkedIn bio previously stated. "All my customers quickly realize my passion for finance and helping all succeed financially and I look forward to displaying that passion for all my new customers."

According to a profile by the Iowa Bankers Association, Winterhof wanted to become a banker since he was a child and he runs his own podcast called Farm4Profit.

"You must take the time to understand what the customer needs to provide them with the best customer service experience. This then translates for me outside of my job in many forms — at home with family, with friends in the community and with guests as we conduct podcast interviews," Winterhof said. "I am still not what I would consider great at it but being in banking has made me much better now than what I used to be!"