Gucci sales fell as Kering SA’s biggest brand grappled with the twin challenges of a luxury goods slowdown and internal tumult, which is set to weigh on the label’s profitability this year.

Comparable revenue at Gucci slid 7% in the third quarter, Kering said Tuesday after markets closed. Analysts expected a drop of 6.2%. Overall, sales at the Paris-based company declined 9%, also missing estimates.

Kering shares fell as much as 4.5% in early Paris trading, bringing this year’s losses to about 18%.

Kering’s performance has been lagging rivals as the luxury group controlled by the billionaire Pinault family navigates management and creative changes at Gucci. The brand, which generates about two-thirds of Kering’s operating profit, replaced its chief executive officer and creative director in the past year.

The disappointing performance will weigh on profitability at the Italian label, Kering’s Deputy Chief Executive Officer Jean-Marc Duplaix told analysts on a call. He said Gucci expects to take a 200 basis-point hit to its earnings margin this year.

Duplaix added that investors shouldn’t expect that margin to improve in 2024, as Kering plans more investments to guarantee the future growth of its crucial brand. Gucci’s recurring operating margin last year was 35.6%.

Creative Director

Last month, the Italian label unveiled the debut collection of new creative director Sabato De Sarno, whose simpler designs marked a departure from the flowing fabrics and vibrant prints of his predecessor, Alessandro Michele. De Sarno’s new creations will go on sale starting in January.

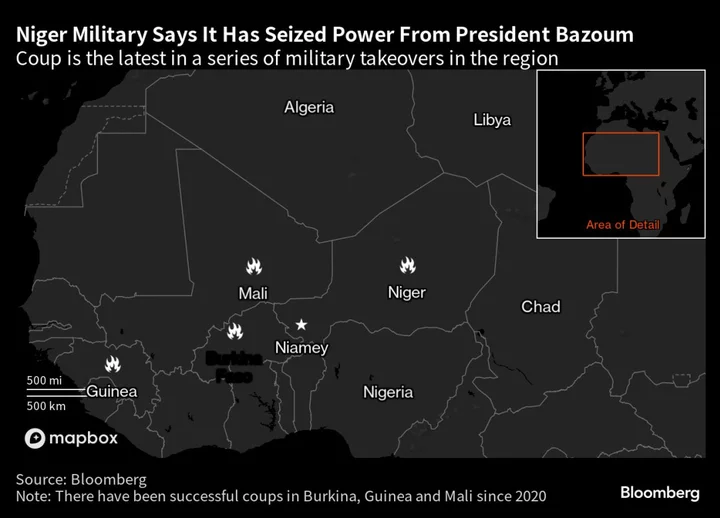

Citigroup analyst Thomas Chauvet said that a “more uncertain macro and geopolitical environment might delay early signs of Gucci’s renaissance.” Duplaix said that “geopolitical risks are mounting and could further impair consumer sentiment,” providing little visibility for the future.

The slowdown extends beyond Gucci. Among Kering’s other labels, comparable sales at Yves Saint Laurent slid 12% last quarter, while the Other Houses unit — whose biggest brand is Balenciaga — fell 15%, both missing estimates. The brands had a high basis of comparison from a year ago and are reducing their exposure to wholesale distribution, Kering said.

“We’re still seeing a polarization in the performance of Balenciaga, depending on the markets,” Duplaix told reporters. Demand in the US, in particular, is still suffering from the fallout over an ad campaign scandal last year, he said.

Kering’s results contrast with those of rival Hermes International, which earlier Tuesday reported sales growth of about 16% in the third quarter on resilient demand for its prized handbags, topping estimates and boosting its shares.

Earlier this month, LVMH Moet Hennessy Louis Vuitton SE, whose brands include Christian Dior and Louis Vuitton, disappointed investors with less robust growth than expected.

(Updates with Kering share price in 3rd paragraph, analyst comment in 8th.)