Grove Collaborative Holdings is replacing its longtime chief executive officer after the seller of household essentials struggled since being taken public during the SPAC craze of the past few years.

Stuart Landesberg, who co-founded the company that would become Grove in 2012, is stepping down from his post to become executive chairman, the firm said in a statement Monday. Jeff Yurcisin, a 48-year-old Amazon.com Inc. alum, will become CEO on Aug. 16. Grove also raised $10 million by selling shares to investment firm Volition Capital through a private placement.

Yurcisin, who also spent four years as CEO of e-commerce retailer Zulily, has a lot of work cut out for him. Grove, which pitches itself as a greener option for cleaning and beauty items, has been operating at a loss for years to invest in the business. But the growth that helped its pre-public valuation top $1 billion has disappeared; revenue fell 17% to $66.1 million in the second quarter.

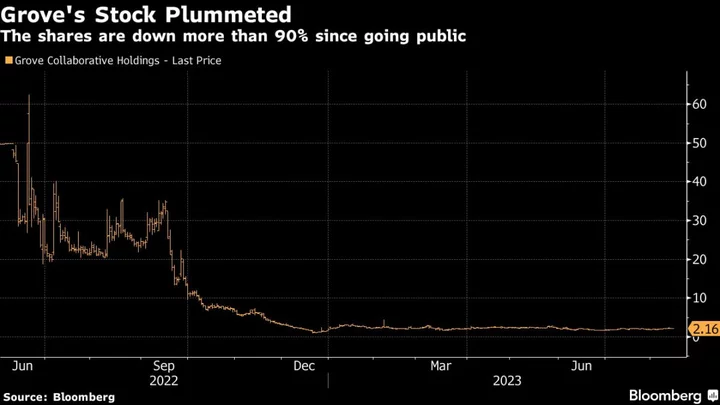

Grove went public in June 2022 after a special-purpose acquisition company sponsored by Richard Branson’s Virgin Group acquired the product maker. Following a few months of volatile trading, the shares tanked as revenue declined. By the end of last year, the stock was in danger of getting delisted for falling below $1.

In June, the company completed a reverse stock split to stay on the New York Stock Exchange. The shares closed on Aug. 11 at $2.16, a more than 90% decline from their public debut, with a market value of $86 million. That fall mirrored the collapse of many companies that went public through a SPAC merger.

Grove does still have believers. Volition Capital bought stock at $2.11 and received warrants to acquire $10 million more at three times that price per share. As part of the deal that gives it more than a 10% stake in the firm, Larry Cheng, a co-founder of Volition, will join Grove’s board. He’s betting that the brand will eventually emerge as a force.

“We see potential,” Cheng said during an interview. “It seems almost inevitable that there are going to be several billion-dollar brands in household consumer essentials.”

Cheng, who’s also on the board of GameStop Corp., said Grove was an attractive investment because it has been able to move beyond selling on its own website to retailers such as Amazon and CVS. The brand also has an opportunity to expand more into health and wellness items such as vitamins and probiotics, he said.

As part of a broader push to improve the company’s finances, the company cut back on advertising last quarter to focus on profitability, Landesberg, 38, said in an interview.

“We’re really trying to behave like a bootstrapped company,” Landesberg said. “And really watch over every dollar.”

--With assistance from Bailey Lipschultz.