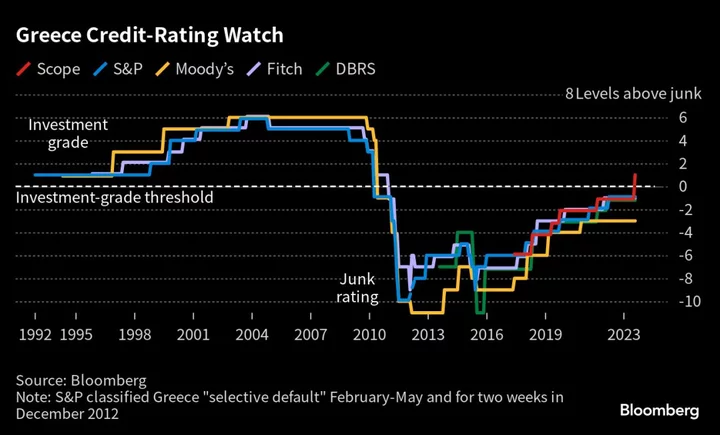

Greek lenders took a step closer to being able to access a deeper pool of debt investors after Scope Ratings restored the country to the ranks of investment-grade nations.

The ratings firm lifted Greece above junk after the market close on Friday, boosting hopes that an upgrade by one of the top three arbiters of creditworthiness could also come soon, first for the sovereign, and then for the banks.

An improved score from S&P Global Ratings, Moody’s Investors Service or Fitch Ratings would lift a barrier preventing fund managers from holding the bonds of Greek lenders, which currently trade at spreads significantly wider than those of European peers. Buyers of Greek sovereign bonds are already anticipating such an outcome, lowering 10-year yield premiums over safer German peers to around 125 basis points, close to the lowest since October 2021.

“For many funds, it’s not about the investment case but whether their mandate allows them to buy sub-investment grade paper,” said Alevizos Alevizakos, managing director in the research division of AXIA Ventures Group in Athens. “They may be ready to pull the trigger but have to wait for the event and can’t invest even a day earlier.”

Scope’s upgrade helps to draw a line under the Greek debt crisis that erupted in 2010, forcing the country to seek a series of international bailouts and raising doubts about whether the country could remain in the euro-zone.

But the lack of an investment-grade rating from the top three ratings firms continues to hold back Greek lenders. Strict rules still prevent many large fund managers from buying Greek banking debt because of the lack of high-grade scores from S&P, Moody’s or Fitch, even though they’re well-capitalized and profitability is running high.

Top Agencies

While an upgrade by top agencies will boost demand for Greek bonds, it is likely to lead to some short-term profit taking among investors who have had a good ride on the securities this year.

Mark Nash, head of fixed income alternatives at Jupiter Asset Management, is one of them.

He said Greek bonds have already done well this year against an improved political backdrop. Meanwhile, banks are in good shape, and the long maturity of Greece’s debt profile means it doesn’t need to refinance and face higher borrowing cost for a long time.

“We’ve been owning Greek bonds all year and it’s been very nice in the sea of nastiness,” said Nash. “Scope’s upgrade is good news, but when one of the bigger agencies do it, then it’s probably time for us to reduce Greek bonds.”

Euro-denominated senior bonds by Greek lenders are indicated between 120 and 160 basis points above those of other European lenders in shorter maturities, according to data compiled by Bloomberg.

Securities that Greek lenders issue to plug capital requirements, such as Tier 2 and additional tier 1 notes, also trade hundreds of basis points wider than European peers. These bonds are broadly unchanged on Monday.

Commerzbank AG analysts Michael Leister and Hauke Siemssen expect Scope’s upgrade to reduce yield premiums on Greek government bonds over their euro area peers in coming sessions, even though the spreads are already fundamentally “rich,” they wrote in a note Monday.

To be sure, Greek lenders including Piraeus Financial Holdings SA and Alpha Services and Holdings SA have already been able to tap the market to raise a combined $1.8 billion by issuing senior debt this year. Investment-grade status would be mostly helpful when trying to place the riskier types of bank debt.

“It’s in the AT1 and tier 2 space where gaining an investment-grade rating would make a big difference in terms of appetite and therefore pricing,” said AXIA’s Alevizakos.

--With assistance from Anchalee Worrachate.

(Adds Greek yield premium in the third paragraph, comment from fund manager in eighth)