Short-term German bonds rallied after the nation’s central bank said it would stop paying interest on domestic government deposits, a move that could spur billions of euros of flows into higher-yielding securities

The rate on two-year notes fell as much as six basis points to 2.95% after the Bundesbank said late Friday it will remunerate domestic government deposits at 0% starting Oct. 1. That compares to the current European Central Bank cap of 20 basis points below the euro short-term rate, which puts it around 3.45%.

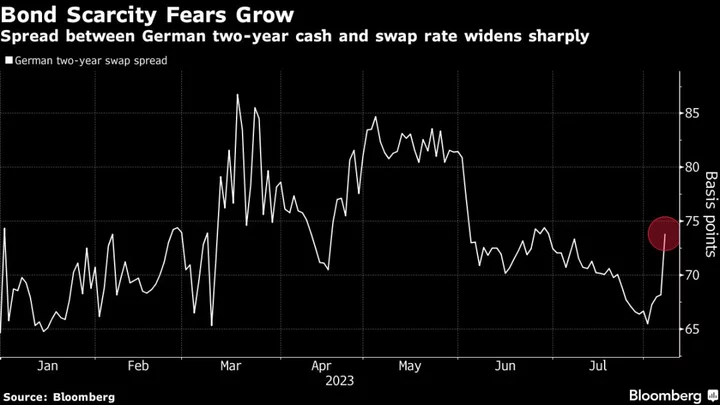

While officials had signaled they would eventually cap the rate, the decision still caught the market off-guard, which was expecting a more gradual drop. It could also reignite concerns over the scarcity of high-quality collateral in the region, especially if the German government starts shifting its holdings quickly.

There were around €54 billion ($59 billion) of general government deposits held at the Bundesbank as of the end of July.

Read more: Return of ECB 0% Deposit Cap Would Shake Money Market, BofA Says

“The Bundesbank is taking no prisoners,” said Commerzbank analysts including Michael Leister. The move to 0% “constitutes a big surprise — and will also be an experiment with unknown outcome for the Bundesbank and the Eurosystem.”

The question of how government deposits would be remunerated has been in focus since last year.

In September, Europe’s governments rushed to lower their cash holdings held at the central bank on the expectation interest would be capped at 0% even as the ECB raised its deposit rate above that level. The ECB ended up temporarily removing the 0% ceiling to avoid a sudden exodus into higher-yielding money markets.

Since May, the central bank started remunerating government deposits at a less attractive rate to encourage a gradual withdrawal of funds. At the time, the ECB said “it stands ready to make further adjustments to the remuneration regime if necessary.”

The analysts at Commerzbank predict German bills will outperform following Friday’s adjustment. German two-year notes outperformed comparable interest-rate swaps Monday, a sign heightened demand was moving the market rather than a shift to the outlook for monetary policy.

“Another BuBill run cannot be excluded and scarcity speculation looks set to intensify further in coming months,” said Leister’s team. That said, the German debt agency “should continue to provide sufficient collateral to the market and stand ready to counter disruptive scarcity if needed.”

--With assistance from James Hirai and Jana Randow.

(Updates throughout.)