Ninety One Ltd., South Africa’s biggest privately owned fund manager, will vote against Sasol Ltd.’s climate report at the company’s annual general meeting on Friday.

The decision adds to pressure on South Africa’s second-biggest producer of greenhouse gases to reconsider its approach on climate. Old Mutual Investment Managers, which owns 4% of Sasol, said earlier this week it intends to vote against a number of resolutions including the climate report, citing the petrochemicals and fuel company’s poor performance on green targets.

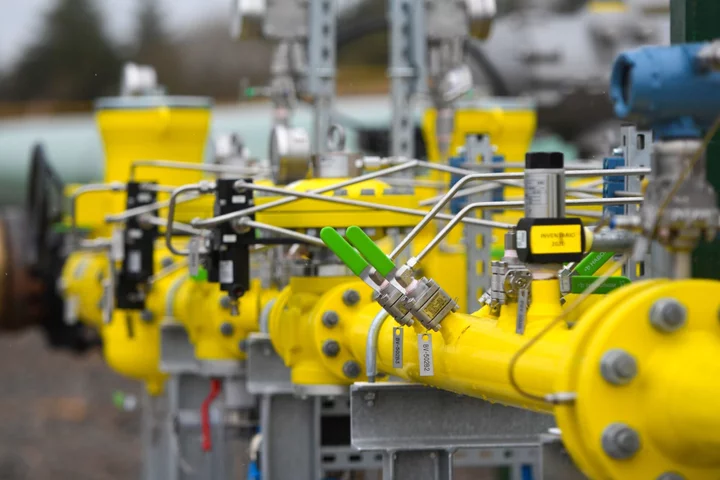

The decision was made because there isn’t enough certainty Sasol will be able to secure the natural gas it needs to replace the use of some of the coal it burns at its Secunda plant to meet its 2030 climate targets, Nazmeera Moola, Ninety One’s chief sustainability officer, said in an interview. If certainty is provided by next year, the fund manager, which owns about 0.9% of Sasol, will endorse the climate report, she said.

The decision isn’t part of a collaboration with OMIG or any other asset manager, Moola said.

Old Mutual has said it declared its voting intentions in a bid to act as “a catalyst” for other investors to vote the same way.

A spokesperson for Sasol said Old Mutual’s comments about its climate policy are inaccurate. The company didn’t respond to a request for comment on Ninety One’s voting intentions.

M&G Plc, which owns 6.7% of Sasol, said it’s too soon to consider rejecting the company’s climate plan, given the complexity of the issues at stake.

“While they have committed to targets, the delivery of these relies on regulation, technology and many outcomes, the delivery of which is out of Sasol’s hands,” David Knee, M&G’s chief investment officer, told Bloomberg. “As such, it is too early to have clarity on what is a highly complex matter, as well as the probability they will be able to achieve their goals.”

Coronation Asset Management Ltd., which holds shares in Sasol, declined to comment. Allan Gray Ltd. said it doesn’t disclose its voting intentions ahead of AGMs.

Sasol, South Africa’s biggest company by revenue, accounts for about a fifth of the nation’s greenhouse gas emissions. It also emits other pollutants including sulfur dioxide, which can cause heart attacks and strokes. The company has set a target of cutting emissions by 30% by 2030 and reaching net zero emissions by 2050.