First Quantum Minerals Ltd. plunged by another 17% as uncertainty deepens over the future of the company’s Panama copper mine, which is set to face a referendum that would also have sweeping implications for the country’s economy and global copper supply.

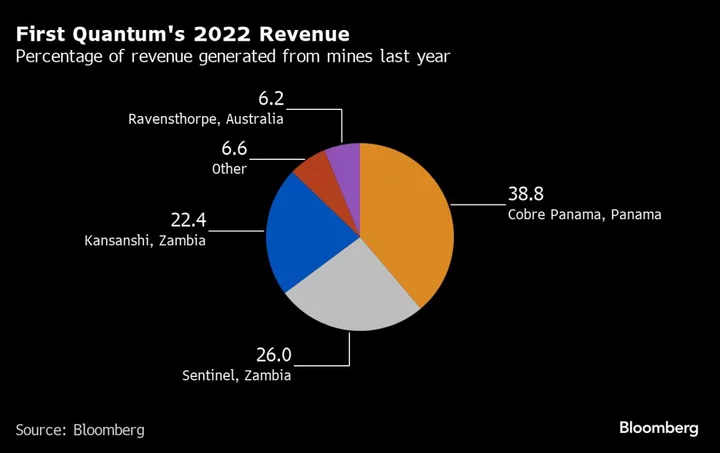

The latest drop brings the company’s losses to more than 40% in the last two sessions as investors assess the outlook for First Quantum’s most important asset. Cobre Panama, one of the world’s biggest and newest copper mines, has generated the bulk of the metal producer’s revenue since it opened in 2019. The operation is projected to account for almost half of the company’s operating revenue next year if it stays fully operational.

The future of the mine has been cast into uncertainty after weeks of civil unrest over its new operating contract, which would extend the company’s mining license by 20 years. The government says it plans to hold a referendum on Dec. 17 for voters to decide whether to extend or revoke First Quantum’s license, though it is still not clear if the referendum can take place.

In a statement on Tuesday, the Canadian company said it had contacted the government to ask for details about plans for the referendum.

First Quantum poured billions of dollars into the project after acquiring it a decade ago, and it has become a company-defining project for the Vancouver-based firm.

Mining companies had drilled in the region since the late 1960s but most deserted the concession in Panama after struggling to navigate its challenging terrain. Teck Resources Ltd. and a Japanese consortium abandoned the concession in the late 1990s, and it belonged to Inmet Mining Corp. for nearly two decades before First Quantum acquired the company in a hostile takeover in 2013.

At the time it produced its first copper concentrate in 2019, the project was cast as a safety hedge to First Quantum’s risky projects in Zambia, where the company wrestled with tax disputes and social unrest.

Cobre Panama is Panama’s only significant mine, accounting for roughly 4% of gross domestic product, according to National Bank of Canada analysts including Shane Nagle. Panama’s economy minister has previously said the country’s growth would have been reduced from 6% in 2023 to less than 1% without contributions from Cobre Panama.

The copper mine is also a significant contributor to the world’s supply of the metal used in everything from wiring to cleaner technology like electric vehicles, accounting for about 1.5% of the world’s copper supply. Copper demand is poised to rise in the coming years while supply stagnates. The projections present a looming challenge for the mining industry, which has struggled to expand copper production on budget and on time.

Read More: Teck’s Copper Mine Cost Blowout Shows Challenges in Industry

“A disruption of production at this mine would be a positive for copper as it would likely push the market into deficit,” Jefferies Financial Group Inc. analyst Christopher LaFemina said in a note on Monday. “We do not see a clear path to a resolution of this issue aside from either significantly higher royalties or international arbitration.”

--With assistance from Zijia Song.

(Updates share performance in first two paragraphs.)