Federal Reserve Bank of Minneapolis President Neel Kashkari said price pressures remain too hot, even as officials assess the imprint that banking strains are having on the US economy.

“Inflation has come down but it’s still well above our 2% target,” Kashkari said Thursday at an event in Marquette, Michigan. “We have seen some softening in wage growth nationally, but it’s very mixed.”

Kashkari votes this year on the policy-setting Federal Open Market Committee.

Policymakers raised rates by a quarter percentage point at a meeting earlier this month, bringing interest rates to a range of 5% to 5.25% and signaling they may be ready to pause their tightening cycle.

Leaving rates at their current elevated levels for some time would allow officials to assess how both the increases and banking-sector stress are affecting the economy, while still tapping the breaks on demand to try and ease price pressures.

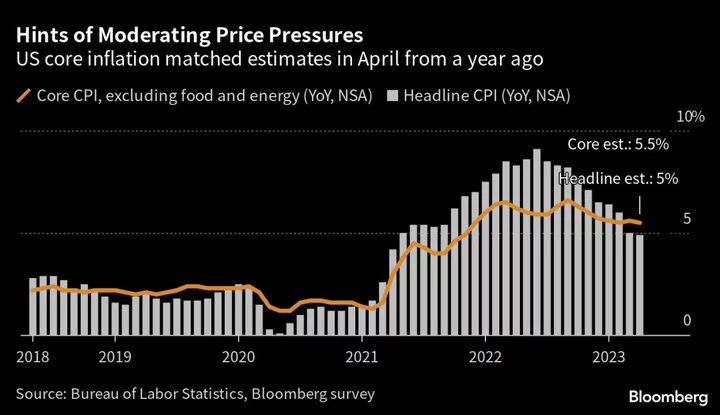

Inflation showed signs of moderating in April, according to a release Wednesday. The consumer price index rose by 4.9% from a year earlier, the first sub-5% reading in two years, the Bureau of Labor Statistics said.

“We’ve been surprised at how high it got, we’ve been surprised at how persistent it’s been. And it’s coming down – there is some evidence that it’s coming down,” Kashkari said. “But so far it’s been pretty darn persistent. That means we’re going to keep at it for an extended period of time.”

Rent increases, which had been a key driver of rising prices, were smaller than over the last year on average, and services prices excluding housing and energy — a category the Fed is watching closely — posted the smallest advance since last summer.

On the other hand, the Minneapolis Fed chief said he saw no evidence yet of a slowing in the services side of the US economy.

“On average American households are still doing very well in terms of their own balance sheets,” he side, while noting that lower income families were getting more stretched.

Kashkari said last month there were “hopeful signs” calm was being restored to markets following the collapse of Silicon Valley Bank in March. That was before the seizure and subsequent sale of First Republic Bank set of a fresh rout in regional bank stocks.

Bank Stress

A report released earlier this week showed tightening credit conditions in the first quarter, extending a trend from last year. The proportion of US banks tightening terms on commercial and industrial loans for medium and large businesses rose to 46%, up from 44.8% in the fourth quarter of 2022, according to a Fed survey of lending officers.

Asked what kept him up at night, Kashkari said it was the “intersection between how embedded is inflation, therefore what does monetary policy need to do, therefore what strains does that put on the banking sector.”

“If the yield curve is going to be inverted for an extended period of time, that creates real stresses in the banking system,” said Kashkari, recalling the global financial crisis of 2008-2009, when he ran the US government’s Troubled Asset Relief Program to shore up banking sector.

“The ‘08 experience is burned into me: When every time we thought we were through it, it’s still burning.”

--With assistance from Sophie Caronello.

(Updates with more Kashkari comment in seventh paragraph.)