The crunch that’s squeezed values of Europe’s best buildings is nearing its end with the outlook for next year increasingly optimistic, according to AEW.

Commercial real estate returns for the best warehouses, offices and stores will be about 9.2% a year in the four years through 2028, according to a revised forecast published Wednesday by the real estate arm of Natixis Investment Managers. The UK, where the correction has been swifter and deeper, will post the best performance with annual returns of 10.7%, it predicted.

The report makes AEW one of the first to call the bottom of the market. The rapid rise in UK and Eurozone interest rates over the past two years has brought Europe’s long real estate boom to a juddering halt, with warehouse values plunging 30% over the past 18 months and offices down 20%. As a result, several developers are filing for insolvency and banks are taking provisions for credit losses.

“The thing that has really changed is the depth of the re-pricing in 2023,” AEW’s European head of strategy and research Hans Vrensen said in an interview. “Our outlook for 2024 is maybe surprisingly positive because we see the re-pricing is mostly done.”

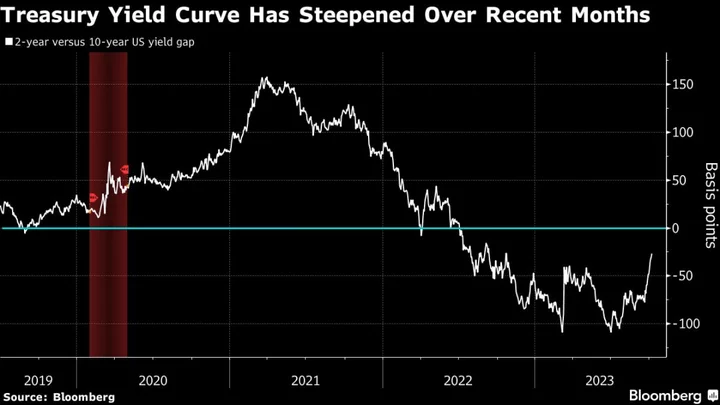

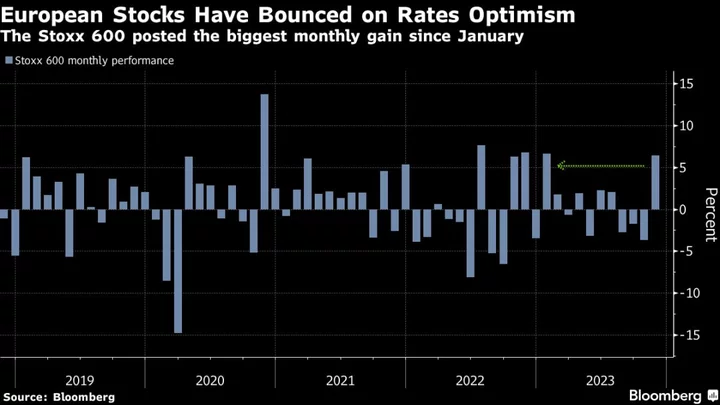

Investors typically borrow when buying property to help increase their returns but the rapid rise in interest rates and the comparatively slower correction in prices has upended that dynamic. But cooling inflation and slowing growth means borrowing costs should come down in the medium term, making debt-backed deals attractive again from 2025 in the Eurozone and 2026 in the UK, AEW forecasts show.

Still, the financing shortfall that’s opened up with declining valuations and more conservative lending terms means there is still a €90 billion debt funding gap to be overcome, AEW’s data show. The asset manager calculates that 16% of all loans secured by borrowers between 2018 and 2021 face a shortfall when they come due, although that’s down from 22% when the company last published the data in August.

“The pain is going through the system, the debt funding gap is effectively a work out,” Vrensen said. “We think the plane is going to take off again but lets say the cleaning crew is still in the back of the plane.”