European stocks edged lower on Friday, but were still set for their third straight weekly gain after the busiest corporate earnings week of the season. Global sentiment today was dented by the Bank of Japan’s move to loosen its signature yield curve control.

The Stoxx 600 was down 0.3% by 8:04 a.m. in London. It has gained about 1% so far on the week, and is tracking its longest winning streak since mid-April. Banking and consumer product stocks outperformed today, while real estate underperformed.

Among individual movers, Standard Chartered Plc climbed after it raised its forecasts for income growth for 2023 and doubled down on share buybacks as rising interest rates propelled earnings, while NatWest Group Plc fluctuated in early trade after it cut its guidance for net interest margins this year. British Airways-parent IAG SA rose as it reported better-than-expected profit on a surge in travel demand.

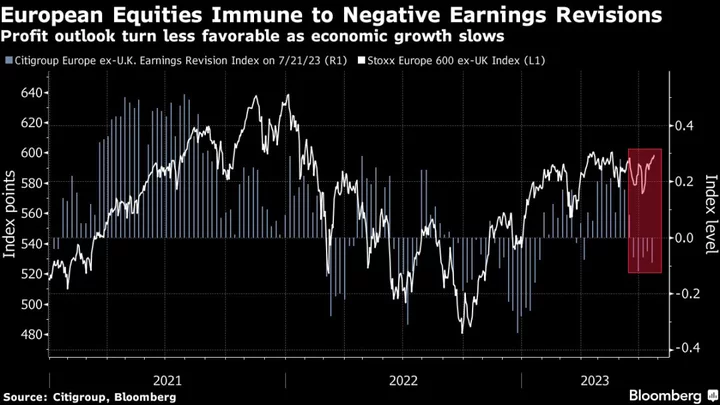

After a sharp rally earlier this year, European stocks are navigating a season of mixed earnings reports and an uncertain economic outlook. While results overall are set for a weaker showing than previous quarters, a lot of the disappointment appears to be priced in and the level of the negative price reaction skew is lower than the previous five quarters, Morgan Stanley strategists said. The Stoxx 600 has gained nearly 3% since the start of the season.

On another bright note, the latest data showed France’s economy grew significantly faster than estimated and inflation eased, providing a positive surprise as rising interest rates stoke recession fears in the 20-nation euro area.

Still, market strategists said they remain cautious on the outlook for stocks in the second half.

“In an environment where inflation remains uncomfortably high, the labor market is strong and most companies maintain solid balance sheets, we believe that economic conditions will remain tight for longer and probabilities for a recession are high,” said Anthi Tsouvali, multi-asset strategist at State Street Global Markets. “In such a backdrop, we would prefer defensives to cyclicals and regions that offer quality earnings. That’s why we prefer US to European equities and we expect the US to continue to outperform in the second half of the year.”

For more on equity markets:

- Shaky Earnings Outlook Can’t Stop Rally for Now: Taking Stock

- M&A Watch Europe: Kering, GAM, Darktrace, Casino, Cellnex, BBVA

- Stellantis Joins the Spinoff Bandwagon Amid IPO Lull: ECM Watch

- US Stock Futures Unchanged; SIGA Technologies Gains

- British Gas Owner Boosts Shareholder Returns: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Farah Elbahrawy and Michael Msika.