European stocks rose as bond yields cooled after the US slowed the pace of its planned sales of longer-term securities, while investors awaited the Federal Reserve’s interest rate decision later Wednesday. Orsted A/S slumped 26% after a $4 billion writedown.

The Stoxx Europe 600 ended the session with a 0.7% gain, near a two-week high. Retailers led gains as Next Plc rallied after raising profit guidance. Orsted said it dropped the development of two US wind projects and recorded impairments as the crisis in the wind industry worsens.

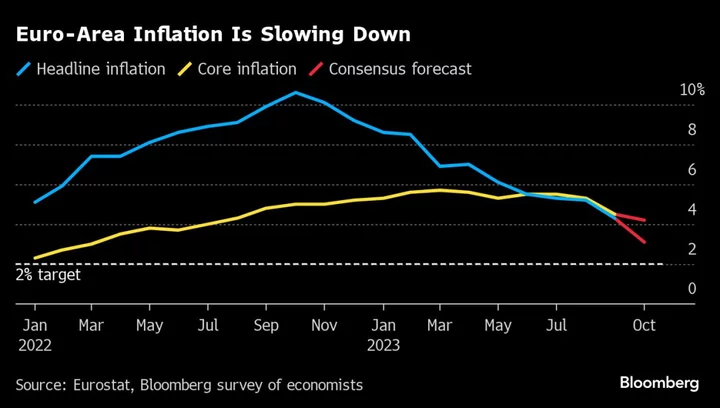

The Fed is poised to hold interest rates steady at a 22-year high for a second meeting, while leaving open the possibility of another hike as soon as December with US economic growth staying resilient. Meanwhile, the US Treasury increased its planned sales of longer-term securities by slightly less than most major dealers expected, a move that signals officials may be concerned about the surge in yields over the past several months.

“We’re reaching the peak tightening level and the important question is going to be what they say about when rate cuts could come,” Jean Boivin, a former Bank of Canada official and the current head of the BlackRock Investment Institute, said in an interview in London. “Central banks are struggling right now to figure out what a 5% 10-year yield means in terms of tightening financial conditions, and markets will wait to see how much it tempers their worries about inflation. That’s a big question that could lead to some market volatility.”

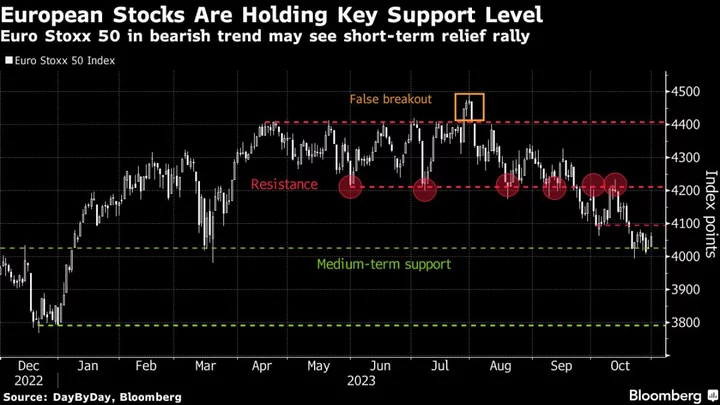

The European benchmark regained some ground over this week after coming very close to wiping out all the gains made this year during the October rout. Other than the Fed decision, investors are parsing earnings statements to assess the health of profits even as European economies slow. Traders are also monitoring developments in the Israel-Hamas war and their impact on oil prices.

Read more: Warnings on Weak Demand Are Piling Up This Earnings Season

“Our short-term outlook is that the likelihood of a year-end rally has increased now, given oversold conditions, an elevated put skew and some shorting. On top, you get more share buybacks in November and December,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “So, for ‘technical’ reasons the likelihood for a bounce seem to be bigger now, given also that we see often a volatility reset after the Fed meeting which will squeeze more participants into equities again.”

For more on equity markets:

- Fed Holds the Key to Make Investors Bullish Again: Taking Stock

- M&A Watch Europe: Telefonica, Liberty, Renault’s Ampere, Casino

- London Faces Shrinking Market, Peel Hunt Study Shows: ECM Watch

- US Stock Futures Fall; WeWork, Paycom Software Fall

- Vodafone Sells Spanish Unit in Turnaround Boost: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika and Kit Rees.