Swedish investment house EQT AB will deploy about $3.4 billion in India through its Asia private equity arm as it steps up deal making in the country.

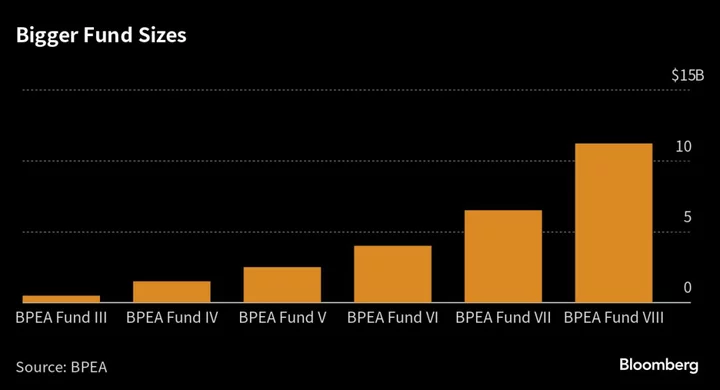

BPEA-EQT plans to commit nearly 30% of the $11.2 billion Baring Private Equity Asia Fund VIII, according to Jimmy Mahtani, a partner at the firm who is responsible for investments in India.

Three of the five early deals from that fund were made in India, he added. EQT acquired Baring Private Equity Asia Ltd. last year to add scale in the region.

“The long-term, structural growth of the Indian economy backed by the government’s investments in physical and digital infrastructure have made India’s investment opportunity real,” Mahtani said.

The planned investment would be the biggest yet by one of the firm’s funds in India. It deployed $2 billion and $270 million respectively into the world’s most populous country with two earlier funds that had raised smaller amounts.

BPEA-EQT’s increasing fund sizes have enabled it to make larger investments. The firm can commit up to $2 billion of equity to a deal, and more through co-investments with its investors, Mahtani said.

Last month, the buyout firm led a consortium in one of the largest private equity financial services deals in India. The group agreed to buy a majority stake in HDFC Credila Financial Services Ltd, the student loans business of mortgage financier Housing Development Finance Corp., which merged with HDFC Bank Ltd. this month.

Read More: BPEA EQT-Led Group Buys Stake in $1.3 Billion Credila

With deal sizes in India on the rise, there will likely be an uptick in club deals like Credila in the next three years, spurring a need for some investors and general partners to join together, Mahtani said.

BPEA-EQT will continue to be the majority shareholder in nearly all the investments, barring a few minority ones, he added.

Infrastructure Deals

Meanwhile, in infrastructure, EQT will look to build up smaller platforms with deals in energy, digital data centers, transportation and logistics, and education and healthcare, according to Piyush Singhvi, a managing director. So far, the firm has committed $750 million through its global infrastructure funds across renewable energy and digital infrastructure in the country.

The firm leaned on its historical ties with Singapore’s Temasek Holdings Pte to enter a partnership to establish O2 Power, a renewable platform in India, in 2020. Marcus Wallenberg, part of the Wallenberg family who are the largest shareholders in EQT, served as a board member at the Singapore state investor for 12 years through 2020.

Infrastructure is becoming “core” in India, reflecting lower but steady returns as the market grows and matures, Singhvi said.