Economists see a stronger US economy into the next year and a smaller rise in unemployment, supporting expectations that the Federal Reserve will keep interest rates higher for longer.

Gross domestic product is expected to advance an annualized 1.8% in the third quarter, nearly quadruple the 0.5% pace projected in July, according to the latest Bloomberg monthly survey of economists. They also see the economy expanding somewhat in the last three months of the year, rather than contracting.

While forecasters are now projecting a stronger economy across the board, consumer spending — which accounts for about two-thirds of GDP — is seen driving momentum as Americans continue to spend at a healthy pace. The Aug. 11-16 survey of economists included 68 responses, and many were submitted before a government report showed retail sales beat estimates in July after upward revisions to the prior two months.

Economists have been growing more optimistic that the US can dodge a recession as inflation cools without doing much damage to the labor market. While Americans will have to contend with the resumption of student-loan payments and high borrowing costs in the coming months, a strong job market is expected to keep powering spending.

Read more: Walmart Lifts Outlook Again, Stays Cautious on US Shoppers

“There are several headwinds facing US consumers over the coming months,” said Brett Ryan, senior US economist at Deutsche Bank AG. “However, the undeniable resilience over the first half of the year and strong start out of the gate in Q3 have raised the probability that the economy may avoid slipping into recession – at least in the near term.”

Economists see the US economy growing 2% on average this year and 0.9% in 2024 — both above last month’s estimates. They also expect the global economy to expand more than initially projected this year, echoing more optimistic forecasts from the International Monetary Fund and World Bank.

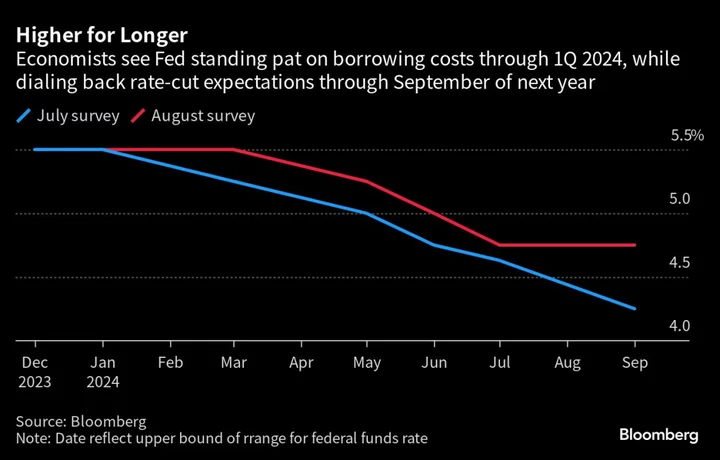

Fed’s Path

Economists in the survey now see the Fed holding interest rates higher for longer amid risks that a stronger economy will keep inflation above their goal. While economists don’t see further hikes on the horizon, they also don’t expect the central bank to cut rates until the second quarter of next year — which is three months later than July’s estimate.

However, economists did revise up their expectations for bond yields through the end of 2025. The two-year Treasury yield is now seen ending the current quarter at 4.82% compared to last month’s projection of 4.65%.

The recent trend of disinflation is expected to continue. Excluding food and energy, forecasters now see the personal consumption expenditures price index cooling more quickly through the end of this year compared to their July projections. Their estimates for the overall PCE measure — which is the Fed’s preferred inflation target — were little changed.

Even so, they see another popular inflation gauge — the consumer price index — rising by more than previously thought.

At the same time, unemployment estimates were marked lower through the end of next year and hiring was seen higher, also supportive of a soft landing.