Investors shouldn’t count on the European Central Bank’s unprecedented bout of interest-rate increases ending in July, as the majority of economists currently predicts, according to Governing Council member Martins Kazaks.

“I don’t think it is that clear yet,” the hawkish Latvian official told Bloomberg on Monday by phone. “We still have quite some ground to cover and further rate increases will be necessary to tame inflation.”

Looking further ahead, he described market bets for borrowing costs to be cut in the spring of next year as “significantly premature.”

The remarks are the toughest since the ECB slowed the pace of its rate increases last week, while pledging that it’s not following the Federal Reserve’s example by opening the door to a pause. Most members of the 26-strong Governing Council have mostly reiterated President Christine Lagarde’s stance that there’s more ground to cover.

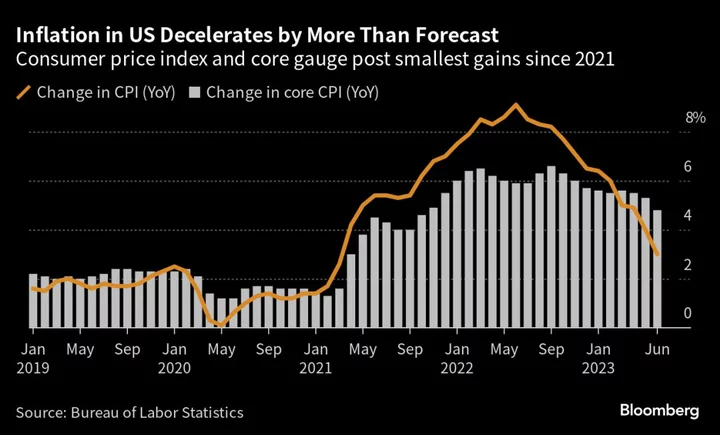

Analysts surveyed by Bloomberg see two more quarter-point hikes, bringing the deposit rate to a peak of 3.75% in July. After officials’ preferred inflation gauge eased in April for the first time in 10 months, investors expect rates to be lifted at least once more.

Commenting Tuesday in a statement, Slovak central bank chief Peter Kazimir said the battle against inflation is “far from won and there’s plenty of ground left to cover.”

For Kazaks, the strategy needed to bring price gains back to the 2% target from 7% last month is twofold.

“The first is raising the rates and of course we don’t know where the terminal rate is,” he said. “Another thing is keeping those rates at elevated and sufficiently restrictive levels.”

That would exclude any imminent reduction in borrowing costs once the so-called terminal rate is reached. The ECB doesn’t forecast a recession in the 20-nation euro zone this year — something that could call for looser policy settings.

With the economy holding up better than anticipated in the face of Russia’s war in Ukraine and the subsequent worsening of the inflation shock, Kazaks said the risk of over-tightening continues to be smaller than the danger of doing too little.

“Persistently high inflation is a bigger problem for society than a relatively short and shallow recession,” he said. “Failing to contain inflation would be a failure because then the policy response in the second go would then need to be much tighter.”

One factor that some analysts have suggested could jolt the ECB off course in the months ahead is a period of rate cuts by the Fed, should the US economy succumb to a downturn.

Kazaks, however, said it’s possible to raise borrowing costs or pause, even as the US heads in the opposite direction, depending on the circumstances.

“The drivers for inflation in the US and the euro area have been somewhat different and that may also require different policy choices at a given moment in time,” he said. “So I’d not exclude it, but that’s still speculative.”

--With assistance from Alexander Weber, Craig Stirling, Jana Randow, James Hirai and Daniel Hornak.

(Updates with ECB’s Kazimir in sixth paragraph.)