The European Central Bank mustn’t take the approach of testing the economy to breaking point and should instead focus on persisting with high interest rates, according to Governing Council member Francois Villeroy de Galhau.

After raising the deposit rate to 4% this month to contain inflation, the danger of doing too much from here must be balanced with the risk of not doing enough, the Bank of France chief said Monday in a speech in Paris.

The drawbacks of insufficient action are “manageable” as the ECB could easily hike further should price gains remain persistently above the 2% target, Villeroy said. A sharp reversal could be needed, though, if it pushes too far, with the economy falling into recession and inflation decelerating sharply, he said.

“‘Testing until it breaks’ isn’t a sensible way to calibrate monetary policy,” Villeroy said. “This suggests we should now focus on the persistence of policy rather than the constant pushing of rates higher — duration rather than level.”

The comments indicate a clear preference for not raising rates any further, even as the French official said his favored strategy doesn’t amount to formal guidance.

Some of his colleagues at the ECB have taken a more hawkish stance: Bundesbank chief Joachim Nagel said last week that it’s too soon to say rates are at a plateau.

In remarks to Market News published earlier Monday, however, Latvia’s Martins Kazaks said September’s “very appropriate” quarter-point hike may allow for a pause in October.

Villeroy — whose speech was entitled ‘Monetary policy in the euro area: was it too late? Or could it now be too much?’ – said the ECB is increasingly confident it can get get inflation back toward 2% by 2025, meaning officials can incorporate a secondary objective of ensuring a smooth path for the economy.

“If we can reach the destination with a soft landing rather than a hard one, it’s a much better route,” he said.

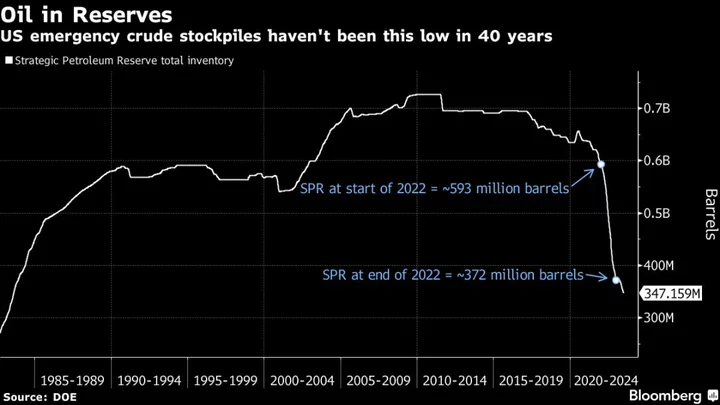

Even so, he flagged the risk of easing policy too soon, urging the ECB to closely monitor the recent jump in oil prices and its effects on inflation expectations and wages.

“A persistent strategy isn’t forward guidance that rates will never increase again,” Villeroy said.