China’s housing crisis has engulfed the country’s private developers, producing record waves of defaults and leaving a shrinking group of survivors.

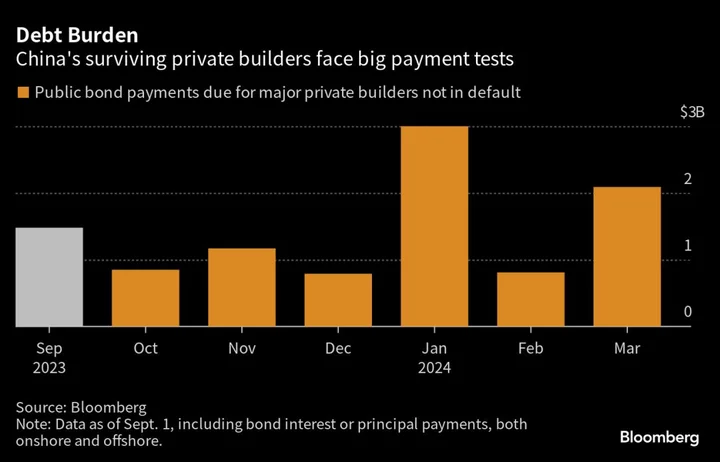

Out of the nation’s top 50 private-sector developers by dollar bond issuance, 34 have already suffered delinquencies on offshore debt, according to Bloomberg-compiled data as of Sept. 1. The remaining 16, led by Country Garden Holdings Co., face a combined $1.48 billion of onshore and offshore public bond payments for either interest or principal in September. The monthly amount is the highest until January.

Chinese junk dollar bonds, dominated by developers, now hover around 67 US cents on average, according to a Bloomberg index.

The debt pressure underscores the unabated payment risks among the sector’s survivors as an unprecedented cash crunch enters a fourth year. While authorities’ latest efforts to arrest a housing slump fueled a property stock rally Monday, it remains to be seen whether they are enough to help prevent a maiden bond default by industry giant Country Garden, an event that promises shock waves across Chinese markets.

“It is uncommon for close to 70%-80% of the non-state-owned issuers in a major sector to run into default or distress within such a short period,” said Zhi Wei Feng, a senior analyst at Loomis Sayles Investments Asia Pte. “More default is definitely expected by now.”

Sitting atop the list of survivors and vulnerable to an imminent payment failure is Country Garden, as the clock is ticking for China’s former top developer by sales to pay a combined $22.5 million in two dollar note coupons within a grace period that ends Sept. 5-6.

Failure to do so would allow bondholders to call a default, which could risk worse fallout than from China Evergrande Group’s in 2021, given Country Garden has four times more property projects. The developer, one of the world’s most indebted builders with about $187 billion of liabilities, told creditors it had yet to make the interest payments, people familiar with the matter said Sunday.

Seazen Group Ltd. and Agile Group Holdings Ltd. are the next to watch, as other builders are either more commercial property-focused or have some levels of state backing, according to Andrew Chan, a credit analyst at Bloomberg Intelligence.

Seazen and Agile have $104 million and $222 million of bond payments, both onshore and offshore, coming due through the end of this year, respectively.

Also on the list are state-linked Sino-Ocean Group Holding Ltd. and China Vanke Co., indicating how developers with certain degrees of government support are facing payment pressure too.

Sino-Ocean has won some breathing room after a unit secured bondholder approval to extend repayment for a yuan note. The company faces $155 million bond payments in September. Vanke, the nation’s second-largest developer that reported lower profit in the first half, has to deliver $34 million of bond payments this month.

The Bloomberg index tracking developers-dominant China junk dollar notes lost 5% in August, the most since May. While it has rebounded since last week after Beijing stepped up its housing rescue campaign, the gauge remains down more than 14% in 2023, set for a third year of declines.

Despite the price slump, some investors remain reluctant to jump in.

Although the market “looks cheap on valuation,” her fund will continue to adopt a defensive and selective strategy, according to Joyce Bing, investment manager of fixed income at abrdn plc. “Policy support has not been very effective to stop the downward trend so far.”

Still, picking the right firms may reward investors with eye-watering gains. In one such example, a dollar note from Dalian Wanda Group Co. recorded a 42% single-day jump in July, a few days before a key unit of the private conglomerate alleviated repayment concerns by making good on a bond.

“Tactical opportunities still exist in the sector,” said Anna Zhang, a credit analyst at T Rowe Price Hong Kong Ltd. “Companies with manageable near-term debt obligations and high-quality land bank are in a better position.”

Here’s a list of the 16 major private developers that have yet to default on public bonds:

--With assistance from Pearl Liu.