Distressed Chinese developer Country Garden Holdings Co. faces two more tests Monday: an initial deadline to pay dollar bond interest and the end of creditor voting on its request to extend payment on a yuan note.

Holders of that local bond due Oct. 21 have until 10 p.m. Beijing time Monday to vote on the proposal to stretch payment by three years. If they reject it, Country Garden would need to pay the 492 million yuan ($67.6 million) of outstanding principal next month, its largest near-term maturity just as it’s struggled to make smaller payments.

There’s also $15.4 million of interest effectively due Monday on a dollar security that matures in 2025, according to data compiled by Bloomberg. It has a 30-day grace period.

Memories are fresh of a similar combined $22.5 million interest payment that Country Garden failed to make by an effective Aug. 7 deadline, raising risks of its first default. That stumble shocked Chinese financial markets before the firm eventually honored the obligation at the last minute of grace periods earlier this month.

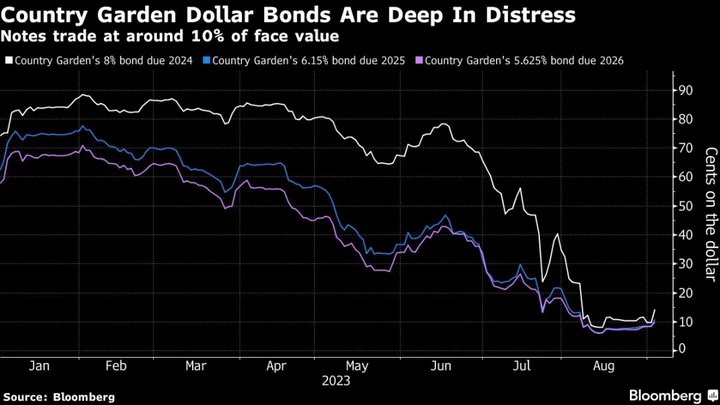

Country Garden was once China’s largest developer before becoming engulfed in a broader property debt crisis and warning it may default. Most of its dollar bonds have fallen to deeply distressed levels below 10 cents after some were near 80 cents in June.

A household name in China famous for building homes in smaller cities, Country Garden is also one of the world’s most heavily indebted developers. A record first-half loss has complicated efforts to trim 1.36 trillion yuan of total liabilities.

The yuan bond on which voting ends Monday—after it was delayed last week for a third time—was issued by unit Guangdong Giant Leap Construction. It’s the last in a group of eight notes totaling 10.8 billion yuan that Country Garden asked to stretch repayment on by three years, with extension of the other seven having already been approved in recent days. The company had also won extension on a separate yuan bond in recent weeks.

That has all helped bring a significant respite, leaving Country Garden with just about 2 billion yuan of principal and interest for local notes with maturities or put options remaining in 2023.

But there’s no shortage of hurdles remaining. At the heart of the challenges are the broader declines in the nation’s real estate sector. The company’s contracted sales plunged 72% from a year earlier in August, worsening after declines in previous months.

Helmed by one of China’s richest women, the developer has become a symbol of the broader property debt crisis that’s led to record defaults and prompted authorities to adjust policy to avoid more contagion. Shares have plunged 60% this year, with a rebound since late August stalling last week.

In a sign of how the crisis has dragged the former giant down, the company was ranked sixth by sales through August, according to China Real Estate Information Corp.