Copper touched a 10-week high after the closure of a major mine in Panama highlighted future supply challenges for the red metal as the energy transition accelerates.

Panama’s government said it will shut the mine owned by First Quantum Minerals Ltd., damping hopes the company might be able to reach a new deal to keep it operating. The project, the subject of mass protests from environmentalists and labor unions, produces about 1.5% of the world’s supply of the industrial metal.

“This is a significant event, adding uncertainty to the supply outlook,” said Craig Lang, principal analyst at researcher CRU Group. “This is likely to place further downwards pressure on copper concentrate market terms as smelters and traders look to cover Panama supply with alternative sources of material.”

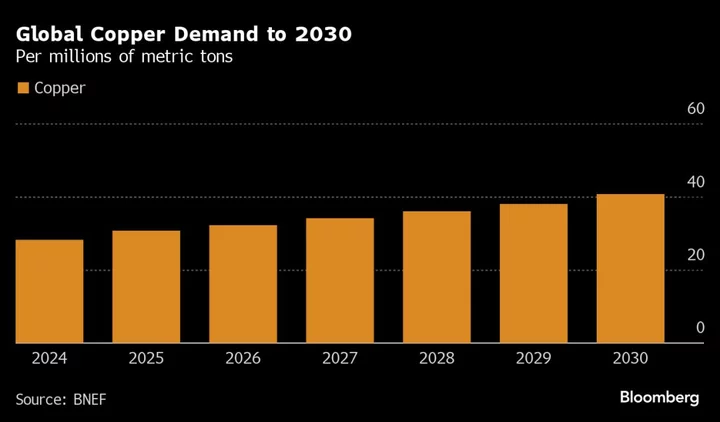

While copper has retreated from a high earlier this year as its traditional sources of industrial demand weakened, there’s growing concern over a constrained long-term supply outlook. The metal’s use in solar panels, wind turbines, power lines and energy storage is expected to boost consumption as the world decarbonizes.

Environmental protests, rising costs and resource nationalism are making it more difficult to develop greenfield projects, however. Adding to the challenges is a trend for increased industrial action. Workers at MMG Ltd’s copper mine in Peru began an indefinite strike on Tuesday, threatening disruptions to production. It’s one of the world’s biggest mines by capacity but has consistently underperformed due to labor issues.

“For the past five years in a row, the mine disruption rate has been above the average of this century,” Lang said.

The events come as some smelters and miners are concluding talks for supply contracts for next year. Chilean miner Antofagasta Plc and Chinese smelter Jinchuan Group earlier this month agreed to copper-concentrate supply contracts for 2024 that set lower processing charges.

Copper dipped 0.1% to $8,466.50 on the London Metal Exchange as of 12:41 p.m. in Shanghai after being up as much as 0.3% earlier. The metal has risen 4.4% this month. Aluminum fell 0.2%, while nickel was up 1.2% following a surge of 4.3% surge in the previous session.

--With assistance from Jacob Lorinc.