Hedge funds talked up Chinese vocational schools and a hydropower producer, marking the return of China stock bets a year after they were conspicuously absent at the Sohn Hong Kong Investment Leaders Conference.

The founders of Oasis Management Co. and Tybourne Capital Management were among speakers at Sohn Hong Kong’s first in-person event since 2019.

It’s a contrast from last year’s conference, when Chinese stock picks were nowhere to be seen following a domestic crackdown on freewheeling technology and consumer companies, mounting geopolitical tensions and rising interest rates. Another theme emerging from this year’s event was the prevalence of corporate governance investment ideas for stocks of companies in South Korea, Japan and India.

Below is a summary of some of the presentations this year:

China Education

Seth Fischer of Oasis Management said that concerns about China being uninvestible were overblown and the government regulatory crackdowns, especially in the education sector, still left some opportunities.

He said he spotted opportunities in higher education and the vocational school segment as those institutions train skilled labor that will become the backbone of the economy, while being relatively untouched by the regulatory crackdown on compulsory education and after-school tutoring.

“They’re the baby that’s been thrown out with the bath water,” said Fischer. Chinese vocational schools are trading at extremely low valuations, he said.

He singled out shares of China Education Group Holdings Ltd., China Yuhua Education Corp. convertible bonds and Hope Education Group Co. credit. These companies offer attractive valuations, fall in line with government policy, and play an important function for the Chinese economy, he said.

More Chinese Stocks

Richard H. Lawrence Jr., founder of Overlook Investments Group, made the case for investors to buy shares of Chinese state-owned enterprise China Yangtze Power Co., which operates hydroelectric power facilities including the Three Gorges Dam. He picked the company for its renewable energy focus.

Yangtze Power’s business stands out for its good corporate governance, a stable model and good margins, he said. It’s going to be China’s prime generating asset in the next 60 years, he said.

The company is “China’s climate-change blue chip,” Lawrence said. “There is nothing that comes close to that, globally.”

The Three Gorges Dam is not without controversy. At the time of its construction, it was criticized for its environmental impact and the displacement of the local population. Sustainalytics gives it a medium risk rating.

Chinese stocks were also a big theme at the Next Wave sessions that feature emerging hedge fund managers.

Eric Wong of Stillpoint Investments touted Shanghai-listed Laobaixing Pharmacy Chain JSC as a buy; Sun Fei of Epimelis Capital touted going long on BYD Co.’s China-listed shares, while shorting the carmaker’s HK-traded stock.

May Yu of Expects Capital highlighted China Resources Beer Holdings Co. for its ability to offer premium alcohol. Sean Ho, chief investment officer of Triata Capital, said Kuaishou Technology is the most under-monetized and under-appreciated platform. He says the stock has at least 90% upside in three years, bolstered by its video, e-commerce and advertisement business.

Corporate Governance

Aside from China, Jay Shin from Seoul-based Quad Investment Management talked about Hy-Lok Corp. and how his fund is pushing for changes at the Korean company.

He said South Korea family businesses are going through issues of succession and corporate governance. His fund, which owns about 5% of Hy-Lok, is just getting started with the firm in making demands to better serve minority shareholders.

Masahiko Yamaguchi, founder of MY.Alpha, endorsed shares of India’s Fortis Healthcare Ltd. He said that current management has been an upgrade and that the long-term demands for healthcare in India made Fortis an attractive bet.

“It’s a great asset and it’s extremely undervalued,” said Yamaguchi, adding that he expects 40% to 60% upside for the stock.

Toby Rodes, co-founder of Kaname Capital, said he saw value in Fukuda Denshi Co., a Japanese medical equipment maker despite its governance issues. Kaname Capital, which mainly invests in Japanese small cap stocks, is pushing for shareholder activism in the country.

Vietnam Grocer

Gordon Yeo, co-CEO of Singapore-based Arisaig Partners, picked Mobile World Investment Corp, a retailer in Vietnam.

Mobile World is expanding into the grocery business, which is hot in Vietnam, he said. Vietnamese households value fresh produce so much, they do two shopping trips per day, he said.

Yeo acknowledged that government arrests and reduced manufacturing hurt Vietnam’s investment appeal. But he said he’s bullish on Mobile World because it pulled levers to boost profitability, making it ready for when the recovery comes.

Copper Firm

Jeremy Bond of Sydney-based Terra Capital pitched investing in NGEx Minerals Ltd. Bond’s 13-year-old firm runs a natural resources fund and a green metals fund.

Vancouver-based NGEx focuses on copper and gold exploration with projects in Chile and Argentina. NGEx Minerals holds the large-scale Los Helados copper-gold deposit, located in Chile, as well as other early-stage projects in Argentina. He said that decarbonization will drive demand for commodities such as copper.

Disco

Eashwar Krishnan of Tybourne Capital Management said he was bullish on Japanese semiconductor-equipment maker Disco Corp. He said the company may see its silicon carbide-related sales nearly quadruple by 2027.

Disco is the dominant maker of tools used to slice, grind and dice silicon wafers and has developed gear that can also process silicon carbide.

The market for silicon carbide used in the automobiles industry is expected to grow at a 39% compounded annual rate over the next five years, due to its higher durability, thermal conductivity and melting point, he said.

Krishnan placed a share price target of 35,000 yen for the company in three years, compared with the stock’s current 17,760 yen.

Other Ideas

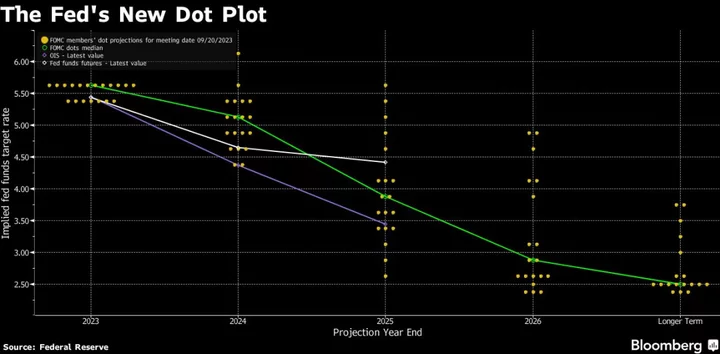

Mark Tinker of Toscafund highlighted BPER Banca as an example of a company with a good balance sheet that can benefit from rising interest rates and gain pricing power.

Huan Wei Hee, chief investment officer at Partners Bay, talked up Malaysian glove manufacturer Hartalega Holdings, saying the company took a disciplined approach toward expansion during the Covid pandemic, while some large peers over expanded.

Edward Lei of Astroll Management sees BOE Varitronix Ltd., the world’s leading maker of auto display modules, as an investment opportunity.

--With assistance from Russell Ward, Adrian Kennedy and Joanne Wong.

(Updates with comments from Triata CIO on investments)

Author: Bei Hu, David Ramli, Lulu Yilun Chen and Jeanny Yu