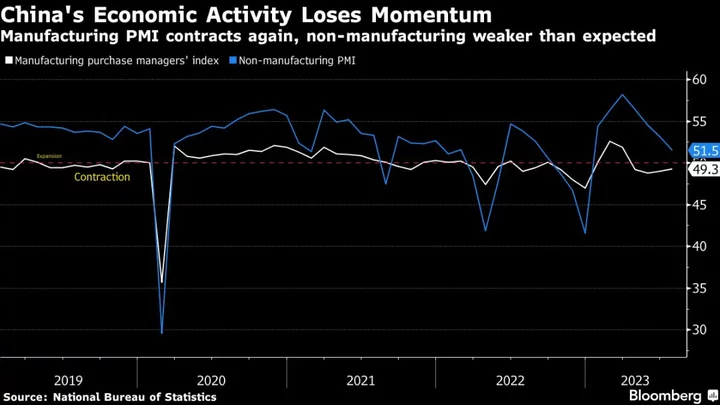

China’s manufacturing activity contracted for a fourth month in July while non-manufacturing activity expanded slower than expected, showing the economy’s recovery remains under pressure.

The official manufacturing purchasing managers’ index rose to 49.3, according to data from the National Bureau of Statistics on Monday, from 49 in June and beating the median estimate of 48.9 in a Bloomberg survey of economists.

The non-manufacturing gauge — which measures activity in the services and construction sectors — eased to 51.5 from 53.2 in June. That was weaker than the reading of 53 expected by economists. A reading below 50 signals contraction from the previous month, while anything above points to expansion.

Adding to existing strains on China’s economy is extreme weather, with heat waves baking northeastern cities including Beijing and spreading to central coastal regions, while the southwest has been hit by heavy rain and deadly floods. The weather problems threaten to put stress on the energy grid and disrupt logistics, as well as production.

Concerns about the state of China’s recovery have been mounting in recent weeks, with early indicators for July showing a weakening of momentum. Economists polled by Bloomberg project growth of 5.2% for 2023, lower than earlier forecasts and more in line with the official target of around 5%.

Contributing to the pessimism is the property market, which is slumping again after an initial rebound. Deflation pressures are also accumulating while foreign demand for Chinese goods is shrinking, the latter sapping a key source of growth that China’s economy had relied on during the pandemic. Consumer spending has slowed, too, amid soaring youth unemployment and struggling household confidence.

Top leaders have signaled more support for the troubled real estate sector as well as a “holistic” package to address mounting local debt. But they still stopped short of offering major fiscal or monetary stimulus at a key meeting last week.