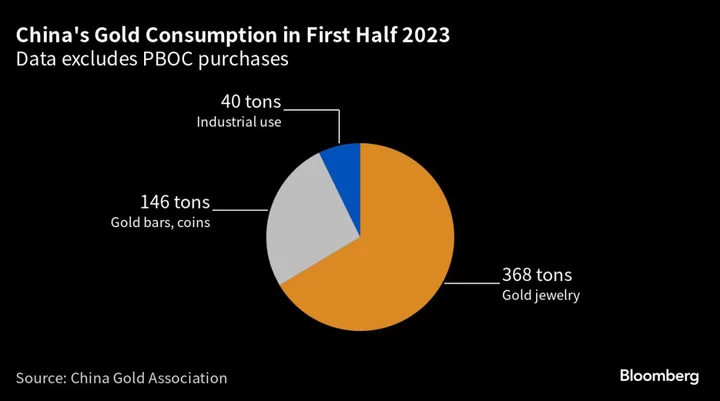

Chinese gold consumption is likely to be buttressed by financial investors and the central bank, although retail demand is more uncertain as the economy weakens, according to the producer-funded World Gold Council.

Bullion’s billing as a haven in times of geopolitical uncertainty or economic stress means that investment demand for gold coins and bars should be “solid” in the second half of the year, Wang Lixin, the WGC’s chief executive officer for China, said in an interview on Wednesday.

Beijing’s push to diversify its foreign reserves, which has seen the People’s Bank of China add to its holdings for nine straight months, is another trend that’s supportive for gold, he said. The central bank bought 103 tons in the first half.

But the prospects for jewelry, the main pillar of demand, look rockier. As the economy has slowed, households have conserved cash. That’s shown up in disappointing retail sales and a lapse into deflation that could worsen demand for costlier items if consumers expect prices to keep falling. Bloomberg Economics reckons the chances of deflation persisting into the first quarter of 2024 are about 35%.

Retail demand in the world’s top gold buyer hinges on whether the economy improves and consumers become more comfortable spending, said Wang.

The outlook is a far cry from the first half when pent-up buying after the lifting of pandemic restrictions boosted China’s gold consumption. That had faded by July, with jewelry sales during the month contracting 10% year-on-year to 21.8 billion yuan ($3 billion), according to the statistics bureau, compared to peak growth of 45% in April.

Meanwhile, concerns over the faltering economy have lifted gold demand among Chinese futures traders, said TD Securities Inc., which highlighted a spate of buying likely linked to weakness in the yuan “as fears rise that China’s economic woes may morph into liquidity woes,” according to a note from the bank.

The Week’s Diary

(All times Beijing unless noted.)

Thursday, Aug. 17:

- Yancoal earnings webcast, 11:00 Sydney

- EARNINGS: Cnooc

Friday, Aug. 18:

- China’s 2nd batch of July trade data, including agricultural imports; LNG & pipeline gas imports; oil products trade breakdown; alumina, copper and rare-earth product exports; bauxite, steel & aluminum product imports

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Cnooc earnings call, 17:00

- EARNINGS: Hongqiao

Saturday, Aug. 19

- Nothing major scheduled

Sunday, Aug. 20

- China’s 3rd batch of July trade data, including country breakdowns for energy and commodities

On the Wire

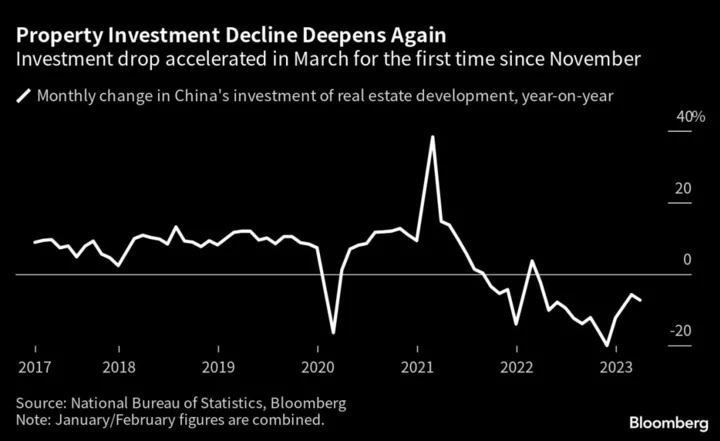

Judging by China’s official statistics, the nation’s housing market has been remarkably resilient in the face of tepid economic growth and record defaults by developers. But the picture emerging from property agents and private data providers is far more dire.

China’s top leaders pledged to expand domestic consumption and support the private sector without detailing any new stimulus measures, the latest in a series of rhetorical attempts to boost confidence in the economy as markets sink and growth disappoints.

--With assistance from Swansy Afonso.