China is likely to report rapid economic expansion for the second quarter, although underlying figures will reveal a more challenging picture.

The comparison with last year, when Shanghai was enduring a Covid-related lockdown, will make Monday’s gross domestic product data look a lot better than was actually the case. GDP likely grew 7.1% for the quarter on a year-over-year basis, up from 4.5% in the previous period, according to economists surveyed by Bloomberg.

Compared with the first quarter of 2023, though, it probably rose just 0.8%. Monthly data for industrial production, retail sales and fixed investment — all scheduled for Monday — are expected to show a marked slowdown in June. Retail sales growth, in particular, likely slid to 3.3% from 12.7% in May.

Economists are focusing on the latter figures to get a fuller picture of China’s recovery. The signs so far have been disappointing: manufacturing activity is contracting, deflation is looming, export demand is falling, and recent holiday spending was subdued.

Speculation has grown that the People’s Bank of China will add more stimulus after a surprise interest-rate cut in June. Officials signaled on Friday that more support may be on the cards, although it’s likely to be limited in scope and targeted toward specific sectors, like the property market and private businesses.

All economists surveyed by Bloomberg predict the PBOC will keep the rate on its one-year policy loans unchanged at 2.65% on Monday, while some expect a small net injection of funds.

What Bloomberg Economics Says:

“The PBOC wants to avoid adding too much stimulus too quickly. It has learned from experience that blasts of monetary easing can cause unwanted side effects.”

—For full analysis from the Bloomberg Economics’ Asia economist team, click here

Elsewhere, a pivotal UK inflation number will help signal the size of the next rate move, retail sales take center stage in the US, and central-bank decisions from Turkey to South Africa may deliver some drama.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

US and Canada

Retail sales figures on Tuesday highlight a busy week of US indicators ahead of the Federal Reserve’s July 25-26 policy meeting. Economists project a healthy 0.5% advance for June sales that would add to evidence of a resilient consumer.

Bolstered by steady growth in employment and worker pay, household demand — while cooling — has underpinned the economy. A sustained increase would help limit recession risks in the wake of the Fed’s aggressive rate-hiking campaign.

Residential construction, home sales and builder sentiment data will offer a fresh read on a housing sector that’s started to stabilize.

Economists forecast housing starts retreated in June after the sharpest gain since 2016. Contract closings on existing-home purchases are seen declining as higher mortgage rates continue to impact the resale market.

On Tuesday, a Fed report is projected to show little change in factory output last month, underscoring a sluggish manufacturing sector.

The highlight in Canada will be inflation data for June after the headline figure slowed to 3.4% in May. The key focus will be two measures tracked by the Bank of Canada: the trim and median core rates, and service inflation. Their persistence above target contributed to Wednesday’s decision to hike rates to 5%.

Fresh data on existing Canadian home purchases and retail sales will show if consumption remains strong despite rising borrowing costs.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

While China will draw most attention, plenty else is going on in Asia.

Group of 20 finance ministers and central bank governors are meeting in Gandhinagar, India, where they’ll likely discuss the state of the global economy and debt relief amid division over Russia’s invasion of Ukraine.

The head of the Bank of Thailand is set to give a briefing Wednesday after signaling earlier in the month that policy tightening will continue.

In New Zealand, where the central bank on Tuesday kept rates unchanged for the first time in almost two years, quarterly inflation data are expected to show a further slowdown.

Australia’s labor market has so far remained resilient to rate hikes, but any weakening in jobs figures on Thursday may point to an end of the policy tightening cycle.

Trade figures from Singapore, Indonesia, Japan and Malaysia will be closely watched to gauge the strength of global demand, though South Korea’s preliminary numbers for July on Friday will offer the most up to date measure.

Japan’s national inflation figures, also scheduled for Friday, may impact expectations for the following week’s Bank of Japan meeting amid speculation of possible policy tweaks.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

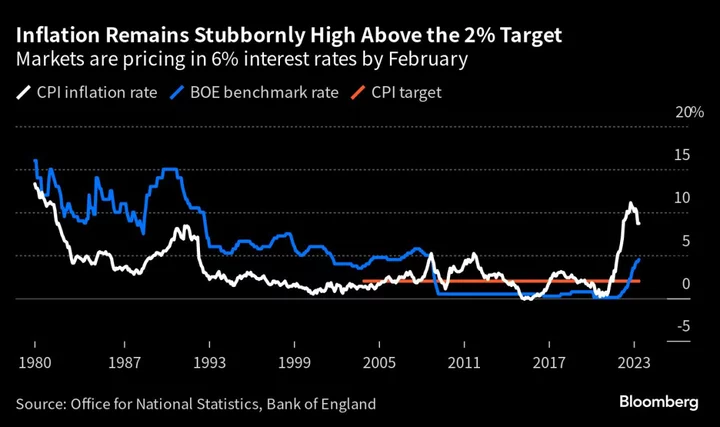

UK inflation will be the data highlight after a recent wage report suggested that price pressures are becoming entrenched.

While Bank of England Governor Andrew Bailey predicted that price growth will slow “markedly” in the second half, following the path seen in the US and parts of Europe, Wednesday’s report may show only limited progress. Any sign of stubborn underlying inflation will cement expectations for another aggressive half-point rate hike to match the previous move in June.

UK retail sales and deficit numbers due on Friday will also inform investors on the resilience of the consumer and the state of the public finances.

In the eurozone, the final take of inflation for June will be released on Wednesday, followed the same day by consumer confidence from across the region.

European Central Bank chief Christine Lagarde is among policymakers speaking on Monday at a conference on central, eastern and south-eastern European economies.

Few other public remarks are scheduled before a blackout period kicks in on Thursday in advance of the July 27 decision, where a quarter-point rate hike has been all but promised.

Turning east, Bulgaria may appoint central bank Governor Dimitar Radev to another six-year term, and also start the procedure to appoint two deputy governors, a move needed for the country to advance its euro area application.

Three major central bank decisions are due elsewhere in the region:

- The Bank of Russia may end its longest rate pause in more than seven years on Friday, with the possibility of an increase in borrowing costs to fight inflation.

- On Thursday, Turkey’s central bank makes its second decision since President Recep Tayyip Erdogan won reelection in May. After hiking by 650 basis points last month, traders will be watching to see if the bank makes a similar move to counter inflation still running at almost 40%.

- The same day, the South African Reserve Bank decision may prove a close call over whether officials pause the steepest phase of monetary tightening since 2006, or increase rates by 25 basis points. Market pricing shows traders are betting on a 40% chance of such a hike.

South African data on Wednesday will probably show inflation in June reverted to the Reserve Bank’s target range of 3% to 6% for the first time since April 2022.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

There are headwinds, to be sure, but the Brazilian central bank’s survey of analysts and Brazil’s May GDP-proxy data posted Monday should again dish up reasons for optimism about Latin America’s biggest economy.

Inflation expectations have fallen for eight straight weeks, growth forecasts have risen for 12 consecutive weeks, and monthly output data have beaten analysts’ estimates for four months running.

On Tuesday, Colombia’s May GDP-proxy figures may show a second straight contraction as the economy cools after a torrid 2022. Economists see growth slowing to 1.5% this year, down from 7.5%.

A light week in Mexico will see reports on international reserves, retail sales and the Banamex survey of economists.

Inflation running just above target may keep Paraguay’s central bank on hold at 8.5% for a 10th consecutive month.

Activity in Argentina had been running hot and cold before a pronounced dip in April. Too many challenges — triple-digit inflation, gathering recession, a shortage of dollars and investor concern about a possible run on the financial system in the midst of an election cycle — argue for yet another negative print for May.

Argentina is widely expected to go into recession this year; economists surveyed by Bloomberg see the economy contracting by more than 3%.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Michael Winfrey, Robert Jameson, Paul Jackson, Laura Dhillon Kane, Jill Disis, Monique Vanek, Paul Wallace, Vince Golle and Zoe Schneeweiss.