China’s film market unexpectedly cooled during what’s typically one of it’s most important seasons, as a lack of blockbuster releases and booming travel demand kept people away from cinemas.

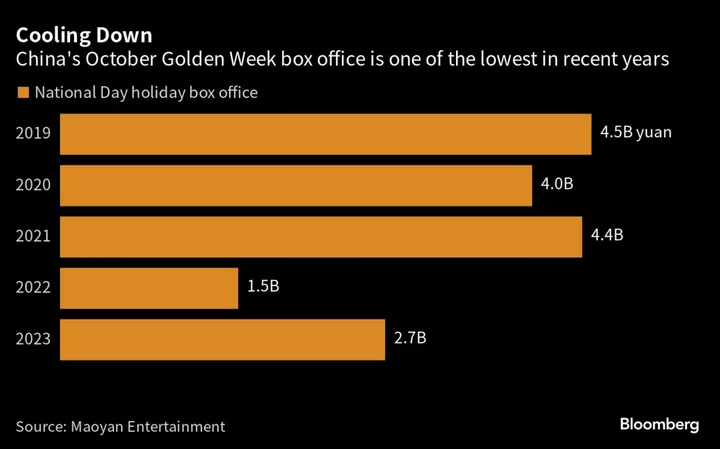

The country collected 2.7 billion yuan ($370 million) in box office sales during the eight-day Golden Week break that ended Friday, down 39% from 2019’s level even though this year’s break was one day longer, according to data from ticketing platform Maoyan Entertainment. That’s also well below estimates from major filmmaker China Film Co. and brokerages for takings to top the record 4.5 billion yuan collected in 2019.

The surprise slowdown is likely to impact full-year performance. Year-to-date ticket sales as of the end of September were 5% lower than pre-pandemic levels, but industry consultancy Artisan Gateway now predicts the full-year figure to be 14.5% less than 2019’s.

The disappointing showing immediately after a record-breaking summer underscores the precarious outlook for consumption. Chinese are splashing their cash on dining out and travel, with this year’s Asian Games in Hangzhou providing an extra boost to domestic tourism, while reigning in spending in other sectors. The divergent patterns add to uncertainty for the world’s second-biggest economy, which is trying to sustain a recovery amid headwinds from weak consumer and business confidence to an ongoing property crisis.

Read More: China’s Precarious Economic Recovery Signals More Support Needed

While the slowdown at the box office isn’t necessarily a pessimistic sign for the economy as a whole, the increased spending on travel and catering means the recovery for other consumer sectors may be slower and face more challenges than expected, said Gary Ng, a senior economist at Natixis SA.

Growing Scrutiny

China’s cinemas also face longer-term challenges, particularly tougher scrutiny on movie content for both domestic offerings and Hollywood titles.

Golden Week’s most popular release — Under the Light, directed by Zhang Yimou — is a symbol of how difficult the approval process can be. A trailer released in mid-2020 advertised a planned debut that year, which never took place. Domestic media outlets including the National Business Daily then reported that one of the film’s production companies said they expected a release in 2021. Last year, the same production firm told investors that the film was still in the approval process and was expected to debut within the year.

The movie was finally released late last month and no official explanation has been given for the delay. Users on top film rating and social networking website Douban have commented that sudden cuts and other edits could be a sign that the movie has been re-worked in order to gain official approval and have made the anti-corruption crime drama confusing and inconsistent. A previous film by Zhang, One Second, was also censored, according to the Hollywood Reporter.

“It will be interesting to see how the domestic industry handles the intense oversight by government censors while also producing films that are creative, entertaining and engaging,” said Chris Fenton, an American film producer and trustee of the US-Asia Institute. “The government’s ability to amplify or throttle box office performance trumps even the best films, including those of Zhang Yimou.”

Read More: China’s Box Office Becomes a Giant Headache for Hollywood

For the rest of the year, Hollywood’s The Marvels and domestic title Be My Family — both to be released in November — could rekindle demand, said Rance Pow, chief executive officer of Artisan Gateway. While China’s box office rebound has been mainly driven by Chinese-language productions, the market could see a further boost if there’s interest in importing more films, including American ones, he said.

Hollywood’s market share in China has been slumping for years amid heightened censorship, worsening bilateral relations and rising Chinese nationalism. American films account for only 8% of box office sales among China’s 20 biggest films so far this year, compared with 28% in 2019.

Without the boost from imported films, “it will take years longer for China to surpass the US” to become the world’s biggest movie market, Pow said.