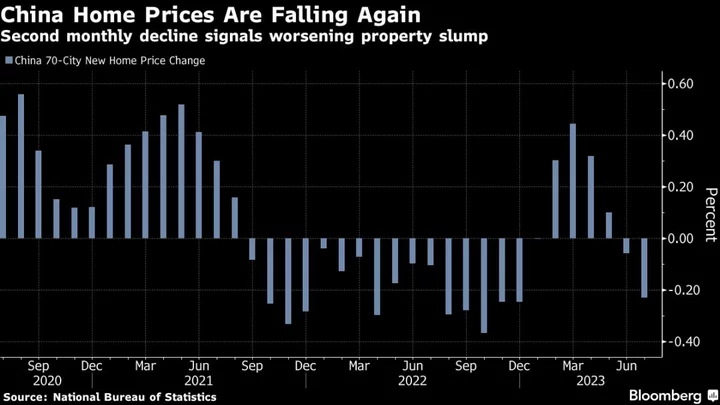

Chinese stocks slid even after policymakers urged top financial institutions to help stabilize a struggling market, an indication of entrenched investor pessimism.

The CSI 300 Index of shares in Shanghai and Shenzhen dropped as much as 0.7%, extending this month’s slump to 7.7% and keeping it as one of the world’s worst performers this year. A key gauge of Hong Kong-listed Chinese firms declined as much as 1.4%. News of more supportive mortgage policies briefly lifted the indexes before the gains were erased within 30 minutes.

The China Securities Regulatory Commission used a seminar Thursday with executives from the country’s pension fund, large banks and insurers to ask them to boost support for the market. The market’s indifference isn’t necessarily a surprise, given regulators have held similar meetings regularly in the past and they have rarely had a significant impact.

“The market is less sensitive to news at this current stage,” said Li Fuwen, a fund manager at Guangdong Value Forest Private Securities Investment Management. “What’s key right now is letting that downward momentum run out organically as polices have already turned supportive but it will take time for the shorts to be exhausted.”

More policy support was announced on Friday, with the official Xinhua news agency reporting on further easing of mortgage policies. Fang Xinghai, a vice chairman of the CSRC, will host a meeting with some of the world’s biggest asset managers in Hong Kong, people familiar with the matter said, in its latest attempt to shore up confidence. Fidelity International Ltd. and Goldman Sachs Group Inc. are among those invited, one of the people said.

The representatives of the participating financial institutions vowed to help stabilize the stock market and boost economic development, according to a CSRC statement. The banks and insurers that attended weren’t named. The meeting also stressed the need to establish an evaluation mechanism with a time frame of at least three years, as well as increasing the scale and weighting of equity investment.

China has taken a series of steps to boost investor confidence recently, from guiding mutual funds to buy their own products and avoid dumping stocks, as well as asking companies to step up share buybacks. The CSRC meeting also coincided with reported announcements by a number of brokerages Thursday to cut stock handling fees.

The country is now also proposing that local governments can scrap a rule that disqualifies people who’ve ever had a mortgage - even if fully repaid - from being considered a first-time homebuyer in major cities, Xinhua said, citing policymakers.

A Bloomberg gauge of Chinese property stocks rose as much as 2.3% before paring half the advance.

The latest move “will release some buying power but the focus still at developers’ existing debt problem,” said Steven Leung, an executive director at Uob Kay Hian Hong Kong.

Authorities have held similar meetings with financial institutions, especially at times of market weakness, including one with private fund managers last week and another earlier with foreign assets managers. The regulator also met the pension fund and large banks in April last year amid a rout, shortly after which the CSI 300 lost another 5.7% before hitting a bottom.

Overseas funds have been fleeing the mainland market, offloading the equivalent of $10.7 billion in a 13-day run of withdrawals through Wednesday, the longest since Bloomberg began tracking the data in 2016. They sold another 1.8 billion yuan ($247 million) of shares early Friday, after a brief hiatus in the previous session.

The CSRC will study suggestions made by the institutions to enhance support and conditions for pension funds, insurance funds and banks’ wealth management funds to participate in the market for the long term, according to the statement.

--With assistance from Li Liu.

(Updates with mortgage easing news in second and fifth paragraphs)