China slid back into deflation in October, highlighting the country’s struggle with shoring up growth through domestic demand.

Consumer prices fell 0.2% last month after hovering near zero in the previous two months, the National Bureau of Statistics said Thursday. That compares with a 0.1% drop forecast in a Bloomberg survey. Producer prices fell for a 13th straight month, dropping 2.6% versus an estimate for a 2.7% decline.

Consumer costs have been stubbornly weak this year. The consumer price index slipped into deflation in July and has been teetering on and off the edge of negative year-on-year growth. While the People’s Bank of China said in August that prices would rebound from the summer rough patch, the latest data shows that assessment is overly optimistic.

“Combating persistent disinflation amid weak demand remains a challenge for Chinese policymakers,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Ltd. “An appropriate policy mix and more supportive measure are needed to prevent the economy from a downward drift in inflation expectations that could threat business confidence and household spending.”

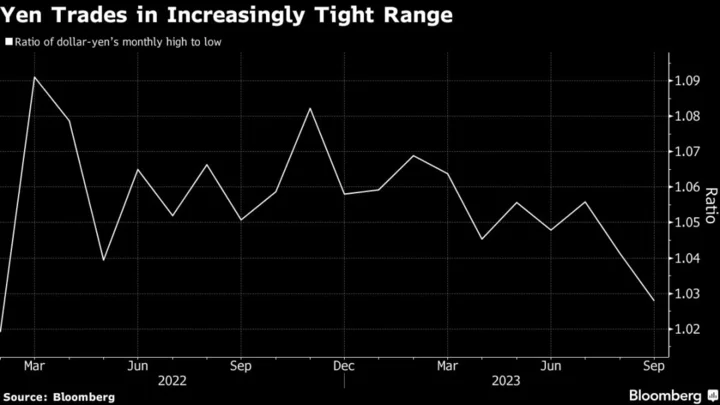

The offshore yuan was little changed at 7.2854 per dollar immediately after the data, kept within in a tight range since Thursday’s open. Chinese 10-year government bond yield held steady at 2.65%.

China’s inflation rate has been low this year due to domestic factors such as a housing slump and weak consumer confidence, and international factors including a fall in global commodity prices from last year’s highs, and weak demand for Chinese made-goods leading to falling exports.

Recent consumer price declines have been driven by large drops in the price of pork, which is the country’s most-consumed meat and so has a heavy weighting in China’s consumer price index. Pork producers increased supply, betting on surging demand after the end of the country’s coronavirus restrictions at the end of last year. But the rebound fell short of expectations.

The weak CPI reading is mainly due to the slump in pork prices, said Tommy Xie, an economist at Oversea-Chinese Banking Corp Ltd. Combined with the weak PPI reading, this indicates persistently weak demand in China, he said.

There could be a silver lining. “This could potentially be seen as positive news for global central banks battling inflation. It suggests that despite the recent recovery of the Chinese economy, there is no immediate threat of China exporting inflation,” Xie added.

Deflation weakens investor confidence as companies record income and profit in nominal terms. It increases their debt servicing pressure, a problem in a highly-leveraged economy such as China’s. It also hurts consumption as consumers might delay purchases due to the expectation that prices will fall further in the future.

China is expected to record a 0.5% CPI growth for full-year 2023, according to the median forecast of economists polled by Bloomberg. That’s well short of the government’s annual target of a rise of around 3%.

Low inflation has been one of the main pieces of evidence cited by economists who argue that China’s economy is growing below its potential and needs more monetary and fiscal stimulus.

Beijing has stepped up monetary and fiscal easing in recent months, such as cutting interest rates and the amount of cash banks must keep in reserve, as well as issuing additional sovereign bonds.

Those efforts to support the economy have helped lift demand for raw materials over the past few months, but that hasn’t necessarily fed through into prices.

Crude oil imports have surged 14% in the year through October, while purchases of iron ore to make steel have risen 6.5%. But at the same time, processors from copper fabricators to steel mills and oil refiners have all seen their margins squeezed as prices have failed to keep pace with their input costs.

--With assistance from Tom Hancock, Wenjin Lv, Fran Wang and Jason Rogers.

(Updates with additional details and context throughout)