China repeated rules to ensure free cross-border money transfers for foreign businesses in its two most important cities amid efforts to win back companies as overseas investment slumps and the economy slows.

In Shanghai’s pilot free-trade zone and Lingang area, officials should make sure foreign investors can freely transfer their investment-related funds in or out of China without delay if the money is “real and compliant,” authorities in the financial hub said in a set of rules that took effect on Sept. 1.

Many of the measures are similar to those previously announced by the central government, including in a June notice published by the State Council, China’s cabinet, aiming to implement “high international standards” in the administration of free trade zones. The Shanghai statement indicates that local authorities are now focused on carrying out those objectives.

Expatriates of foreign companies based in those areas, including staff from Hong Kong, Macau or Taiwan, can freely move their wages and other legal incomes out of the country according to the law. The currency type, amount or frequency of the remittances won’t be restricted by an organization or individuals, according to the Shanghai notice.

Beijing has proposed a similar regulatory push for the whole city, according to draft rules published Wednesday that are now awaiting public feedback.

The Chinese capital city is also exploring exempting overseas firms from foreign-exchange registration for their reinvestments. The local government said the proposed rules are aimed at facilitating and encouraging foreign business investments.

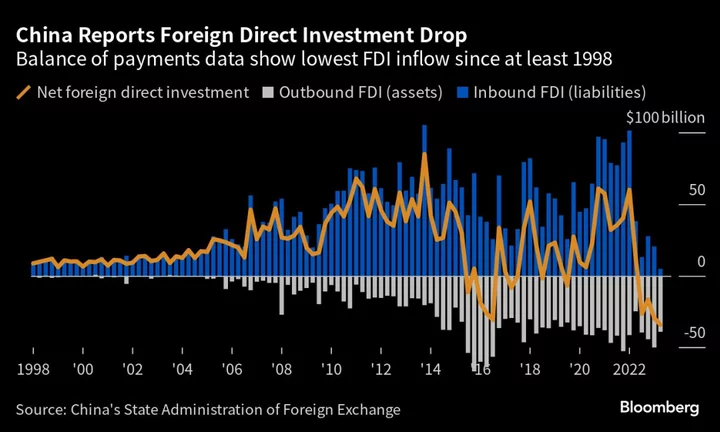

The repeated emphasis on rules governing non-Chinese companies’ money flows comes as President Xi Jinping’s government is ramping up measures to reverse the nation’s foreign investment slump. The State Council issued a 24-point plan in August to court overseas firms with pledges to offer them better tax treatment and make it easier for their workers to obtain visas.

Western firms in China are now the gloomiest they’ve been about the future in decades, largely due to geopolitical risks, according to a recent survey by the American Chamber of Commerce in Shanghai. Persistent tensions with the West, coupled with China’s economic slowdown, have sparked a $188 billion exodus from Chinese stocks and bonds from a December 2021 peak through the end of June this year, diminishing the market’s clout in global portfolios.

“Faced with the general trend of foreign investors diversifying away from China, Beijing has every reason to slow down this pace as best as it can, especially given the current challenging economic situations,” said Neo Wang, Evercore ISI’s New York-based managing director for China research. “These look like coordinated moves addressing an important topic that was omitted” from the 24-point August guidance, he added.

China is facing its biggest capital flight in years, creating concern for authorities as it worsens pressure on the beleaguered yuan.

The currency has been hammered from all fronts as money leaves its financial markets, global companies look for China alternatives and a revival in overseas travel hits services trade. All of this is captured in the latest official data, which shows an outflow of $49 billion in the capital account last month, the largest since December 2015.

The exodus, spurred by sputtering growth in the world’s second-largest economy and a widening interest-rate gap with the US, helped push the yuan to a 16-year low. The risk is that accelerated money outflows weigh more on the currency, sapping the market’s appeal and in turn resulting in further capital flight that can destabilize financial markets.

--With assistance from Tom Hancock, Yujing Liu, Ran Li and Jeanny Yu.

(Updates with background.)