Chinese leaders are making their most forceful push yet to end the nation’s property crisis, ramping up pressure on banks to plug an estimated $446 billion shortfall in funding needed to stabilize the industry and deliver millions of unfinished apartments.

Policymakers are finalizing a draft list of 50 developers eligible for financial support that includes Country Garden Holdings Co. and Sino-Ocean Group and indicated a pivot by Beijing to help some of the most distressed builders. Meanwhile, the country’s top lawmaking body said banks should increase funding for developers to reduce the risk of additional defaults and ensure housing projects get finished.

As Chinese President Xi Jinping steps up support for the broader economy, moves this week indicate a widening of support with efforts to put a floor under the property crisis that’s plagued the nation’s finance industry for years. While developer stocks climbed in recent days, many investors remain wary authorities haven’t gone far enough yet to rekindle growth in a vital area for the broader economy and the push is likely to further squeeze profits at the nation’s largest lenders.

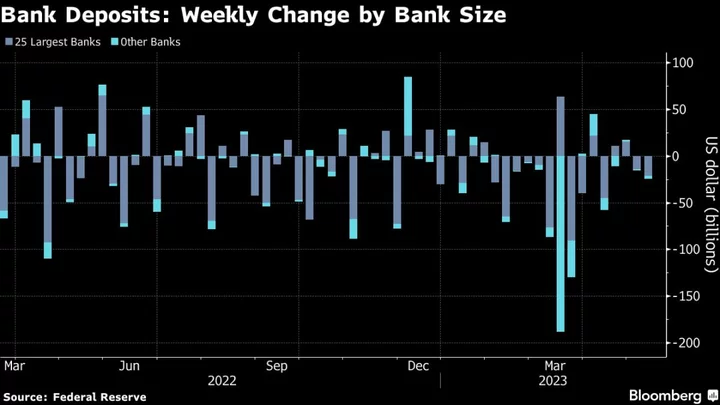

The $56 trillion banking industry has been battling shrinking margins and rising bad loans since they were drafted by authorities to backstop the economy and prevent risk spillover from the sluggish property sector. Authorities had guided banks to trim deposit rates three times over the past year to ease their margin pressure, and slashed banks’ reserve requirements twice this year to boost their lending capacity.

Net interest margins of the big state-owned banks dropped to a record low 1.74% at the end of the first half of 2023, below the industry’s 1.8% threshold seen as necessary to maintain a reasonable amount of profitability.

The sector’s shares have taken a beating. A Bloomberg index of Hong Kong-listed Chinese banks tumbled as much as 18% this year from a high in May, while the big four state banks remain near record low valuations of about 0.4 of their book value.

The task remains challenging. Nomura Holdings Inc. estimates that the total funding gap to complete the remaining housing units would be around 3.2 trillion yuan ($446 billion), according to a note this month from chief China economist Lu Ting.

Increasing funding would ease “panicked expectations” of households, said members of the standing committee of the National People’s Congress, China’s Communist party controlled parliament. The comments, by members who have nominal oversight of the central bank under the guidance of the Communist party’s leadership, adds pressure on the PBOC to do more to support property. The comments were published Wednesday.

Meantime, Bloomberg reported Wednesday that Country Garden, along with Sino-Ocean and CIFI Holdings Group Co. were included on China’s draft list of 50 developers eligible for a range of support. Regulators are set to finalize the roster and distribute it to banks and other financial institutions within days, according to people familiar with the matter.

--With assistance from John Cheng.