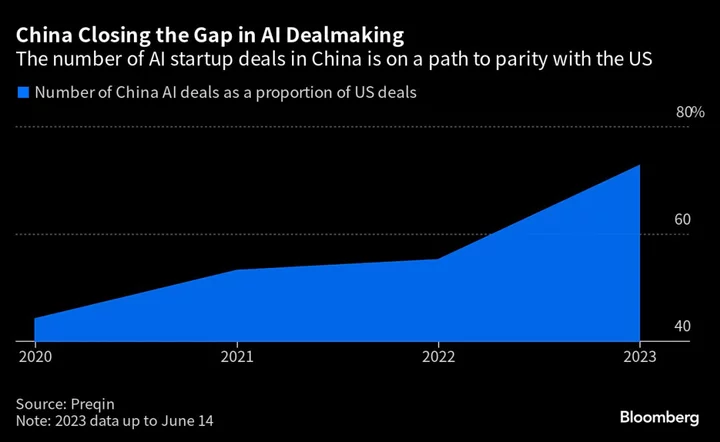

China wrapping up its crackdown on tech firms and switching to supporting the industry sets the tone as the country’s earnings season swings into action.

“Big tech earnings may show continued recovery, with profits expected to rise 10.4% year-on-year in 2Q,” Bloomberg Intelligence analysts including Marvin Chen said. Tencent Holdings Ltd., JD.com Inc. and Bilibili Inc. are among the majors reporting this week.

US President Joe Biden imposed limits on US investments in China to restrict the country’s ability to develop next-generation military and surveillance technologies that might threaten US national security. That’s as Beijing relaxes its stance amid a weakening economy. Chinese Premier Li Qiang urged local governments to offer more support as he met with the nation’s leading tech firms last month, promising a fair environment and lower compliance costs.

Hon Hai Precision Industry Co., a major supplier for Apple Inc., plans to move more of its operations away from China to mitigate risks from tensions with the US. It’s increasing investments to more than $1.2 billion in southern India.

Besides tech, Beijing has been trying to revive its troubled property market, including announcing rules to ease down-payment and mortgage rates for first-home buyers. Longfor Group Holdings Ltd. reports earnings in a market where confidence is fragile after real estate developer Country Garden Holdings Co. failed to pay two dollar bond coupons on time.

In the Chinese new-energy vehicles landscape, Xpeng Inc. announces results after the country outlined a series of measures to bolster car purchases.

Highlights to look out for:

Monday: Hon Hai’s (2317 TT) investors will pay attention to updates on its $600 million investment in two new component factories in India’s Karnataka state as it diversifies from China. Second-quarter net income probably dropped 22% to NT$25.9 billion ($816 million). The shift to focus less on the maturing smartphone market to servers and components should strengthen its credit profile by reducing its reliance on Apple, according to BI analyst Cecilia Chan.

Tuesday: Indonesia’s GoTo Gojek Tokopedia (GOTO IJ) may post a 13% increase in gross revenue, estimates show. Still, the gross transaction value may be relatively weak due to long holidays during the quarter, Citi analysts Ferry Wong and Ryan Davis wrote in a note. Chief Executive Andre Soelistyo, who helped build the company over the past eight years, was replaced by Patrick Walujo in June. GoTo’s shares have fallen around 76% since a peak in June last year as tight competition has kept the firm in the red. The outlook is expected to improve slightly in the second half as Indonesia boosts spending ahead of the election, Citi said.

- Australian health-care giant CSL (CSL AU) is expected to deliver at the top end of its fiscal 2023 revenue and net income guidance, BI analyst Michael Shah said. Total revenue may jump 26% to $13.3 billion, estimates show. The firm has said it expects a foreign currency headwind of as much as $250 million as part of its full-year profit forecast, up from an earlier estimate of $175 million. The focus remains on margins at the CSL Behring unit as the recovery from the pandemic has been slower than initially anticipated, Shah added.

Wednesday: Tencent’s (700 HK) video account traction and positive advertisement demand bodes well for its ads business in the quarter, according to Nomura and Citi. Goldman Sachs expects revenue grew 4% and 24% for domestic and international games, respectively. China’s proposed new rules to limit screen time for children could dent its medium-term growth, BI analysts Robert Lea and Tiffany Tam said. Second-quarter revenue probably rose more than 13% to 152 billion yuan ($21 billion), with a 9% gain in game revenue and 23% jump in online advertising, estimates show.

- JD.com’s (JD US) core electronic-products segment is expected to outperform the industry, given its national logistics and supply-chain network, according to BI. The e-commerce platform last month unveiled an artificial intelligence model called ChatRhino for enterprise use, as competition heats up the AI space. It also aims to establish an independent groceries arm by merging its 7Fresh supermarket chain with other online services, echoing plans by rival Alibaba. Second-quarter revenue may reach 280.2 billion yuan, estimates compiled by Bloomberg show.

Thursday: Chinese video-sharing services provider Bilibili’s (BILI US) revenue growth was probably fueled by a 25% jump in the advertising business and a 10% climb for value-added services, Bloomberg consensus shows. It may face headwinds from rising youth unemployment in China, which hit a record in June, BI said. Comments on how it will increase monetization in the advertising and VAS businesses will be closely watched, BI added. Higher VAS demand could bring it closer to the operating profit target for fiscal 2024.

Friday: Chinese electric-vehicle maker Xpeng (9868 HK) remained unprofitable as deliveries probably slumped 35%, estimates show. Last month, Volkswagen AG unveiled a $700 million investment in Xpeng, with BI analysts Joanna Chen and Steve Man saying it may ease cash-flow pressures. The partners plan at least two new EV models, with the first due in 2026. Xpeng’s new models, including the P7i sedan and the G6 SUV, may revive volume growth in the second half, but margins may “remain shaky” amid stiff price competition, BI added.

- Chinese developer Longfor (960 HK) may see sales to climb this year as its construction capacity provides timely new supplies, BI’s Kristy Hung and Lisa Zhou said. Contracted sales in January to June jumped 74% to 98.5 billion yuan, based on Bloomberg calculations. Longfor’s higher exposure to tier-1 and strong tier-2 cities in China suggests it’s better placed than some peers for potential property policy stimulus, BI added. Earlier this month, China’s central bank promised more funding support for the private sector after meeting with industry executives. The company has room to raise $3 billion in equity, ample for covering the $1.2 billion of bonds maturing in the next 12 months, BI said.

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS on the Bloomberg terminal

- Click to see the highlights to watch this week from earnings reports in US and Europe

Author: Rachel Yeo, Justina T. Lee, Harshita Swaminathan and Reina Sasaki