China’s sovereign bonds are an “obvious” trade as the central bank will ease monetary policy for at least another year to support a slowing economy, according to Invesco Ltd.

The People’s Bank of China will need to maintain loose monetary policy as a recovery of the nation’s over-leveraged property sector will be painful and take time, said Freddy Wong, head of Asia Pacific fixed income. The yields on longer-maturity bonds may decline by another 10 basis to 20 basis points, he said.

China is “rebooting the economy, the monetary policy is more on the easy side and that’s where the attractiveness will come,” Wong said in an interview in Hong Kong last week. There’s also little currency risk as Beijing wants to maintain stability, he said.

Global funds are increasingly turning positive on Chinese debt after a record exodus last year, with the month of June marking a second consecutive month of inflows. Invesco joins Pacific Investment Management Co. and JPMorgan Asset Management in favoring Chinese debt as stuttering growth prompts rate cuts by the PBOC, with economists forecasting that more easing may come as soon as this month.

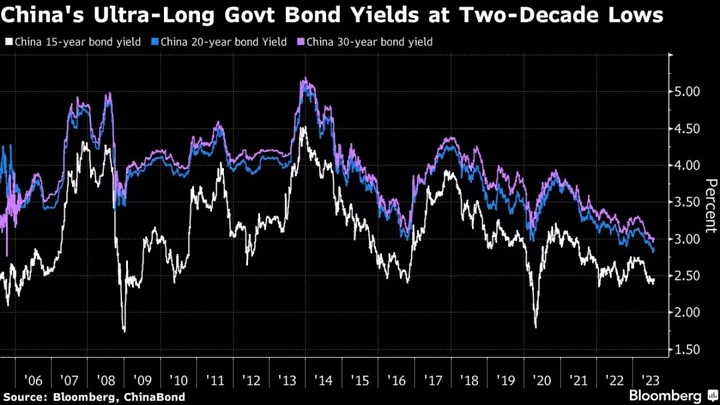

Chinese bonds have rallied since the start of the year as a slew of weaker-than-expected economic data raised expectations of more stimulus measures. The yields on the 15- and 20-year government bonds are down about 20 basis points this year, and both tumbled to the lowest since 2002 in late July.

“When you lack growth, and you are slowly stimulating, allowing an interest-rate environment to keep rates lower for longer, this is why the China trade has been very obvious,” Wong said, without giving details on his allocation.

Invesco manages $1.5 trillion of assets.