China’s biggest state banks are offering local government financing vehicles loans with ultra-long maturities and temporary interest relief to prevent a credit crunch amid growing tension in the $9 trillion debt market, according to people familiar with the matter.

Banks including Industrial & Commercial Bank of China Ltd. and China Construction Bank Corp. have started to ramp up loans that mature in 25 years, instead of the prevailing 10-year tenor for most corporate lending, to qualified LGFVs with high creditworthiness in recent months, said the people, asking not to be identified discussing a private matter.

Some came with waivers on any interest or principal payments in the first four years, though the interest will be accrued for later, the people said. The total size of the longer-term loans to LGFVs couldn’t immediately be determined.

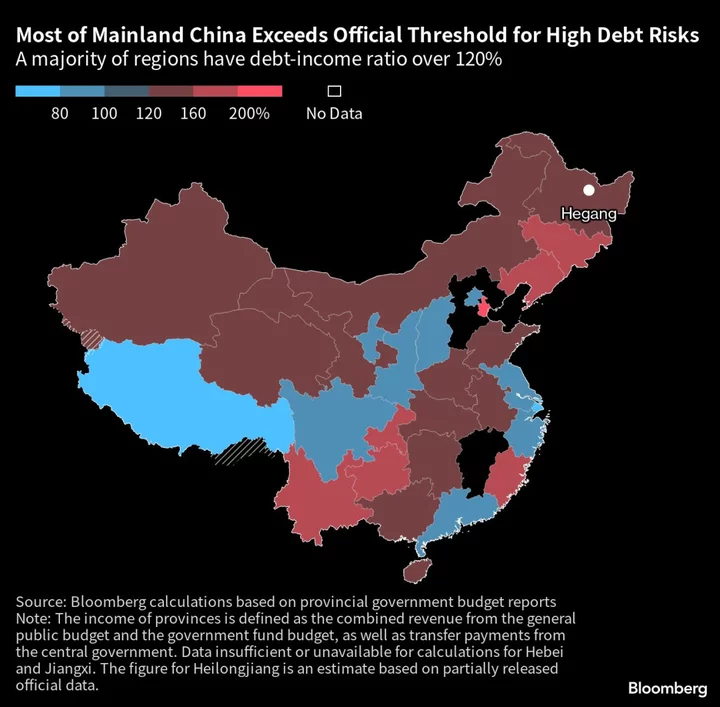

The move comes at a time when concerns over financial fragility in the world’s second largest economy — particularly among China’s local governments — have made policymakers wary of repeating mega-stimulus packages of previous downturns. Instead they’ve turned to credit expansion to avert potential defaults at the government level, where a broad measure of official borrowing has swollen to some $23 trillion according to estimates from Goldman Sachs Group Inc.

Media representatives of Beijing-based ICBC and Construction Bank didn’t respond to requests for comment.

There’s also increasing focus on the $9 trillion debt market for LGFVs. While none have defaulted on a public bond, a recent last-minute payoff of a note raised fresh concerns about the sector’s debt-servicing abilities.

At the end of last year, a LGFV in China’s poor southwestern province of Guizhou announced that it reached an agreement with banks to extend loans of about $2.3 billion by 20 years. In addition, the company will make only interest payment in the first ten years and pay the principal via installments in the following decade.

Local government finances are strained as land sales — a major source of fiscal income — dried up amid an ongoing real estate crisis. Slumping land sales and massive Covid-induced expenditures have weakened the ability of local governments to keep LGFVs, which are mostly tasked with building infrastructure, afloat.

LGFVs have also bumped up purchases of land. LGFVs bought about 30% of land sales in May, up from around 22% in April, according to a tally by Huachuang Securities. That was the first month-on-month increase this year after the firms pulled back from buying earlier, the brokerage said in a report.

Banks Dilemma

Beijing has rolled out a raft of measures to prop up the economy, including asking big banks to lower their deposit rates at least twice in less than a year to boost lending, squeezing their margins.

Tasking banks with helping the cash flows of local governments may further aggravate challenges. Banks have continued to lend to the LGFVs at low interest rates with the belief that local authorities will not let any of them fail.

While LGFVs, which usually have strong demand for loans, can easily help banks achieve their lending targets, there’s a risk of creating more non-performing loans since many of the investments by the LGFVs have struggled to make a profit to cover debt payments.

The International Monetary Fund estimated in February that nationwide there was 66 trillion yuan ($9.1 trillion) of LGFV hidden debt at the end of 2022, up from 40 trillion yuan in 2019. A quick increase underscores how local governments ramped up off-book borrowing and spending during the pandemic.