China will likely set its headline deficit at 3.5% of gross domestic product or higher next year, according to several economists who suggested a recent unusual mid-year budget revision foreshadows greater fiscal support to come.

UBS Group AG, China International Capital Corporation, and Kaiyuan Securities Co. all expect the government to raise the deficit ratio in 2024 to well above 3% of GDP. Beijing has previously tried to keep its headline number at that level or lower, but last month increased the 2023 ratio to 3.8% as part of efforts to support the economy.

That recent budget revision “may indicate a changed approach to fiscal policy,” wrote UBS chief China economist Wang Tao in a note, adding that she expects the government to set the ratio at 3.5-3.8% in 2024.

With the housing market and exports expected to remain weak next year, raising the budget would help boost economic growth.

CICC economists Zhang Wenlang and Peng Wensheng also expect the headline ratio next year to be set at 3.5-3.8% of GDP, and said they see more deficit spending directed toward areas such as social security, science and education. Kaiyuan Securities analyst He Ning wrote in a note this week that the deficit may rise to 3.5-4% of GDP.

Those projections are in line with recommendations by some economists linked to the Chinese government — including Zhang Yansheng, a former senior official at China’s main economic planning agency. Beijing should set its headline deficit at 3.8% of GDP, or 5.18 trillion yuan ($710 billion), he said during a conference presentation in October.

China’s headline deficit refers to the gap between revenue and expenditure recorded in China’s general budget, which mostly covers day-to-day spending. Beijing often uses funds leftover from previous years to lower that deficit. Some economists exclude those carried-over funds to get a more accurate picture of the budget’s actual fiscal impact.

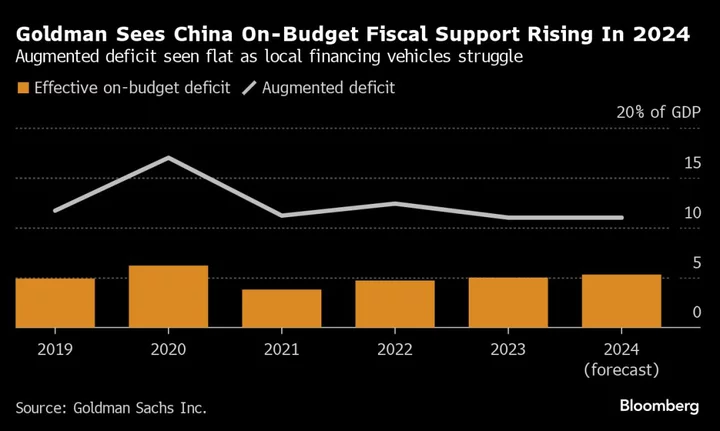

For example, Goldman Sachs Group Inc. economists led by Hui Shan forecast that China’s headline deficit will fall to 3.2% of GDP next year. But they see the effective on-budget deficit, which excludes transfers of left-over funds, rising to 5.3% of GDP in 2024 compared with 5% this year, suggesting more fiscal support.

Economists also look at wider deficit measures — which can include spending funded by local government bond issuance and debt issued by local government financing vehicles, or LGFVs. Those are generally several multiples higher than the headline deficit. That kind of local-government financed spending has been under strain this year, as the property slump has lowered local government income.

Goldman’s widest deficit estimate will remain unchanged from 2023 next year at 11% of GDP. The economists forecast that increase in the amount of “special-purpose” bonds issued by local governments, along with rising lending by state-owned policy banks, will be offset by lower net issuance of bonds by LGFVs.

With US interest rates likely to remain high, monetary easing could increase capital outflows and so “authorities may therefore prefer to rely on fiscal easing to support growth and boost sentiment next year,” the Goldman economists wrote. They predict real GDP growth of 4.8% next year.

Economists surveyed by Bloomberg currently expect growth to slow to 4.5% in 2024 after expanding 5.2% this year. The Politburo — the Communist Party’s top decision-making body — generally meets in December to set economic targets for the next year, though they are not usually made public until the spring.

Following its budget revision, Beijing hinted at boosting central government debt issuance at a twice-a-decade financial conference late last month. People’s Bank of China Governor Pan Gongsheng said in a speech this week that the central government’s debt burden is “relatively light.”

In the short term, it’s important for the government to “step up the magnitude of fiscal policy,” said Wang Yiming, a member of the People’s Bank of China’s monetary policy committee, at the Caixin summit in Beijing on Friday. He said the central government’s leverage ratio is the “lowest among all major economies” at around 21.4% in 2022, meaning “there’s still a lot of space.”

“Next year we can raise the fiscal deficit again to inject a fresh source of energy into the economy, which is the government’s credit, and to drive the economy’s recovery,” he added.

A lively debate is taking place in Beijing about next year’s headline deficit target, according to Citigroup Inc. economists led by Xiangrong Yu who cited conversations with think tanks, regulators, former policy advisers and local experts.

“One commented that it could be difficult to go beyond 3.8% in 2024, unless things turned out worse than expected again,” the economists wrote. “Others held the view that 3.8% is not a high number, and China could totally go beyond that if the top leadership agreed.”

--With assistance from Yujing Liu.