If all goes as planned — and it’s a real if — iRobot Corp. will be gobbled up by Amazon.com Inc. once regulators sign off, and the fact that it’s losing money won’t matter at all.

It’s a bet the Carlyle Group is taking, in return for a big gain in the meantime.

The private equity firm extended a $200 million loan to the maker of Roomba vacuum cleaners to give it time to ride out the wait. In return, Carlyle stands to earn more than 14% a year, with some extra safeguards thrown in to help cover the risk. One ensures it will get a large return even if the loan is paid off early.

The deal illustrates how nimble private-credit lenders can seize on novel opportunities that open up in markets. It’s also another example of how readily available credit still is — albeit at a price — even with the Federal Reserve poised to continue its monetary policy tightening.

In this case, Carlyle is effectively providing iRobot with a bridge loan to carry it through what could be a trying antitrust review, since regulators in Washington and Europe have been taking a more aggressive stance toward corporate tie-ups.

When Amazon announced it would buy iRobot last year for $1.65 billion, antitrust experts said it was likely to face tough scrutiny. That has come true, with the merger facing in-depth investigations by the US Federal Trade Commission and European Union regulators. EU authorities have expressed concern the takeover could thwart competitors by giving the e-commerce giant access to a new stash of user data. They set a deadline of Nov. 15 to vet the potential impact.

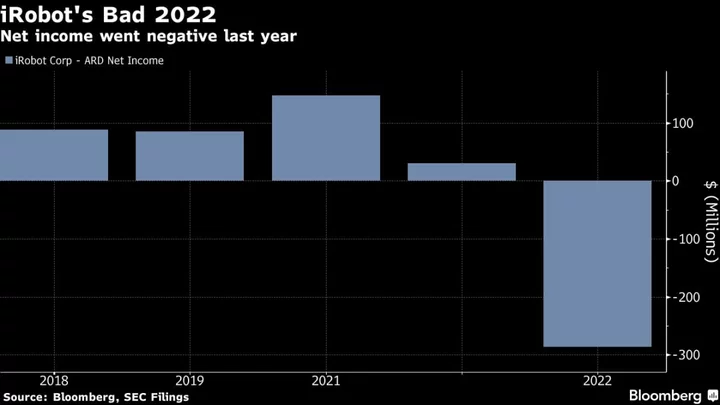

That’s left iRobot in limbo as it burns through cash. The company posted a net loss of about $286 million in 2022, according to Securities and Exchange Commission filings. As of April 1, the company’s cash and cash equivalents were $47.9 million, compared with $117.9 million at the end of 2022, according to its earnings report.

“iRobot is taking on new financing that we believe is sufficient to support our operations in a hyper competitive environment and meet our liquidity needs as well as pay off iRobot’s existing debt,” iRobot Chairman and Chief Executive Officer Colin Angle said in a statement Tuesday.

Spokespeople for Amazon, iRobot, and Carlyle all declined to comment.

Carlyle, which lent the money through its private-credit arm, is charging iRobot nine percentage points over the Secured Overnight Financing Rate, according to a filing. That’s well above the six to seven percentage point spread frequently seen on private credit loans, pushing the annual interest rate to a little over 14%, based on current levels.

Carlyle also secured significant protections. For one, if iRobot pays back a portion or all of the loan early, the company is required to pay Carlyle an additional amount that guarantees it still gets a return ranging from 1.3 to 1.75 times the amount being repaid.

If the deal doesn’t work out and Amazon pays a termination fee, then iRobot has to use it to pay down the debt. The loan documents also include a stipulation that iRobot must maintain at least $250 million worth of cash, accounts receivables, and inventory on hand at the end of each month, enough to cover the loan.

“This new financing is the outcome of a thorough process and represents the best terms reasonably obtainable on additional financing to support our operations,” iRobot’s Angle said.

The lifeline, though, has already proved painful for the company’s shareholders. Amazon lowered the price it’s paying to $51.75 per share from $61 to compensate for the planned increase in iRobot’s debt.

On Tuesday, iRobot shares dropped nearly 14% to about $40.46. The gap between the trading price and what shareholders will get if the Amazon deal closes shows investors have doubts that — even with the extra time — it will ultimately go through.

--With assistance from Davide Scigliuzzo.

(Updates with closing share price in final paragraph.)