MELBOURNE, Australia--(BUSINESS WIRE)--Jun 5, 2023--

Specialist carbon market investor Carbon Growth Partners (CGP) has reopened its Carbon Growth Fund No.2, seeking to raise US$200 million by mid-2024 including an initial US$20 million before the end of June 2023. The fund targets a 20% annual return by investing in a diversified portfolio of carbon credits and carbon offset projects.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230605005604/en/

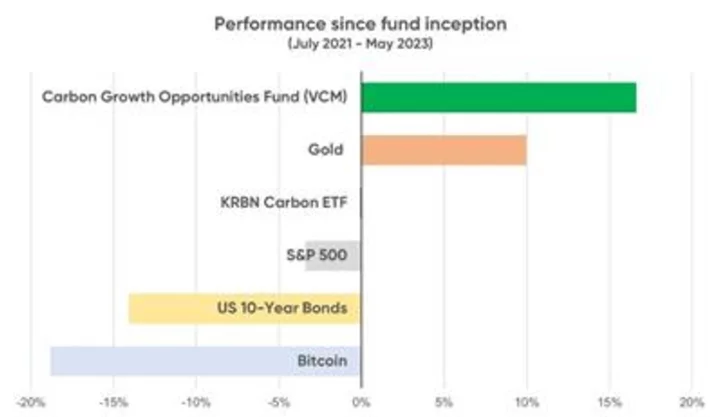

Performance since fund inception (Graphic: Business Wire)

The capital raise comes as CGP announced that its first fund, the Carbon Growth Opportunities Fund, has significantly outperformed major asset classes including cash, stocks, bonds, gold and crypto, generating a 17% return to investors since inception in July 2021^.

“Carbon remains one of the most under-priced asset classes and we anticipate significant price rises as companies meet their commitments to reduce net emissions,” said Carbon Growth Partners CEO, Rich Gilmore. “Reopening Carbon Growth Fund No. 2 will allow investors to capitalise on that opportunity while providing finance to high-quality, nature-based and technology-based solutions that accelerate climate action around the world.”

Carbon offset markets are a critical component in reaching net zero emissions, particularly for hard-to-abate sectors. Studies published in 2023 by ratings agency Sylvera and analytics firm Trove Research found that companies who offset their emissions achieve up to 100% more internal decarbonisation than those who don’t use offsets. Since inception, CGP has invested more than US$230 million in projects that together have resulted in the verified reduction or removal of 37 million tonnes of greenhouse gases. In addition to the climate impact, CGP’s investments have helped to address 15 of the 17 United Nations Sustainable Development Goals.

CGP fund investments can be found in 27 countries across five continents. Priority investments include nature-based climate solutions, renewable energy and efficient household devices. Projects are evaluated using a comprehensive framework to ensure the quality and integrity of the outcomes, which considers a range of environmental and social factors, and seeks to ensure equitable benefit sharing with local communities. The current capital raise for Carbon Growth Fund No.2 will close on June 30, 2023.

About Carbon Growth Partners

Carbon Growth Partners is a leading investment manager in global carbon markets. CGP invests in a portfolio of highest integrity carbon assets to deliver three key outcomes: generating financial returns, protecting and restoring nature, and accelerating climate action by bringing high-quality carbon offset solutions to responsible businesses.

^ Sources:

Asset | Performance July 21 – May 23 | Source |

Carbon Growth Opportunities Fund | 16.6% | Carbon Growth Partners |

Gold | 10.0% | |

KRBN Carbon ETF | -0.1% | |

S&P 500 | -3.4% | |

S&P 10-Year Treasury Index | -14.1% | |

Bitcoin | -18.8% |

View source version on businesswire.com:https://www.businesswire.com/news/home/20230605005604/en/

CONTACT: For furthermediainformation:Mark Jackson

Reputation Works on behalf of CGP

markj@reputationworks.co

+852 6469 2260

KEYWORD: AUSTRALIA/OCEANIA AUSTRALIA

INDUSTRY KEYWORD: ENVIRONMENT CLIMATE CHANGE FINANCE CONSULTING BANKING BUSINESS PROFESSIONAL SERVICES GREEN TECHNOLOGY ASSET MANAGEMENT

SOURCE: Carbon Growth Partners (CGP)

Copyright Business Wire 2023.

PUB: 06/05/2023 04:30 PM/DISC: 06/05/2023 04:29 PM

http://www.businesswire.com/news/home/20230605005604/en