Japanese brokerages are gearing up to offer more alternative assets to the nation’s wealthy, who are increasing in numbers even as the overall population falls.

Mizuho Securities Co. expects more sales this fiscal year after selling about 15 billion yen ($102 million) of funds focused on private assets in the year ended March 31, in its first 12-month period of making those offerings to wealthy individuals, according to Miho Migita, head of private placement fund development division.

The Tokyo-based brokerage is expanding its suite of products such as private credit, which are non-bank loans to borrowers including risky companies. Mizuho has a team to develop alternative funds for wealthy clients, and the staff has increased to 23 people from 15 when it started in 2021, Migita said.

UBS SuMi Trust Wealth Management Co., meanwhile, said it has seen private assets that it oversees more than double over the past three years in Japan, without specifying the amount. It started selling private credit products targeting its high-net-worth clients last year.

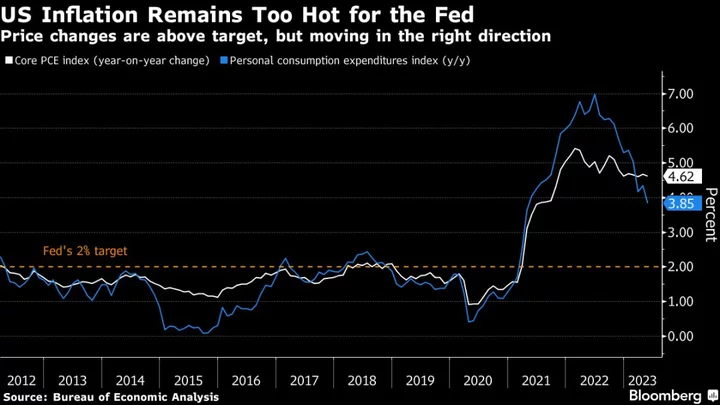

Like investors worldwide, many of the wealthy in Japan are becoming more keen to park their cash in private assets like equity, credit and real estate that aren’t traded in public markets and are seen as less vulnerable to broad selloffs. Private assets are booming globally after decades-high inflation and rapid interest-rate hikes weighed on both shares and bonds, sapping investor confidence in the traditional strategy of holding 60% of their assets in equities and 40% in debt.

“As listed securities face market volatility, it’s getting difficult to effectively diversify portfolios with listed assets, and more and more customers are looking for something different,” said Kaoru Fujita, managing director of private wealth solutions at Blackstone Inc. in Japan.

Blackstone, the world’s largest alternative-asset manager, is among the firms that see opportunities to offer more private credit products to rich Japanese after a strong start for a fund it launched with Daiwa Securities Group Inc. in April.

Wealthy Japanese households owned an unprecedented 364 trillion yen of financial assets that nearly doubled in the decade to 2021, according to data from Nomura Research Institute. It defines owning at least 100 million yen in financial assets as wealthy, and the number of households in that category jumped 84% over that period to a record 1.49 million.

If they shift to riskier investments, that may result in a jump in flows from Japan. Investors there have tended to be more financially conservative than their global peers, holding more than 50% of their assets in cash or bank deposits, according to Bank of Japan data. That’s a much higher ratio than in the US or Europe.

Liquidity Risks

Private assets carry the risk that because they are less liquid than publicly traded securities, they will likely be harder to unload if market sentiment takes a dive. There’s also concern that private credit products tend to have floating interest rates, increasing the odds that if repayment costs rise, borrowers won’t be able to pay back the debt and will default.

UBS SuMi explains to investors that in the long term, illiquid private assets can offer higher returns than public securities. Private equity offered average annual returns of 13.3% for 2001-2021, higher than 6.7% for global stocks and 4.4% for debt, according to UBS data.

The firm recommends that its wealthy clients in Japan include about 20% of alternative assets in their portfolio and a higher portion if they want to keep them for longer periods, said Daiju Aoki, regional chief investment officer at UBS SuMi in Tokyo.

(Corrects start of UBS SuMi private credit product sale to last year in fourth paragraph.)