Treasury traders will be on high alert in the coming week for signs out of Washington on whether the US will careen toward a market-upending default — or will clinch a last-gasp debt deal once again.

The drip-feed of economic data and comments by Federal Reserve officials are poised to take a rare backseat, as the window to raise the debt ceiling closes fast. The Treasury warned Friday that, as of May 10, it had just $88 billion in hand of extraordinary measures — effectively accounting gimmicks — to keep it from crashing into the debt ceiling.

Negotiations between President Joe Biden and House Speaker Kevin McCarthy will therefore take on an outsized importance for world markets in the coming days, even with US retail sales figures and an appearance by Fed Chair Jerome Powell on the agenda.

“This is just another stressor at a point where the system is fairly fragile,” Kelsey Berro, a fixed-income portfolio manager at JPMorgan Asset Management, said on Bloomberg Television. “If we passed the X-date and did not have the money we needed to continue to pay bills, it would be a fairly stressful situation for the broader markets.”

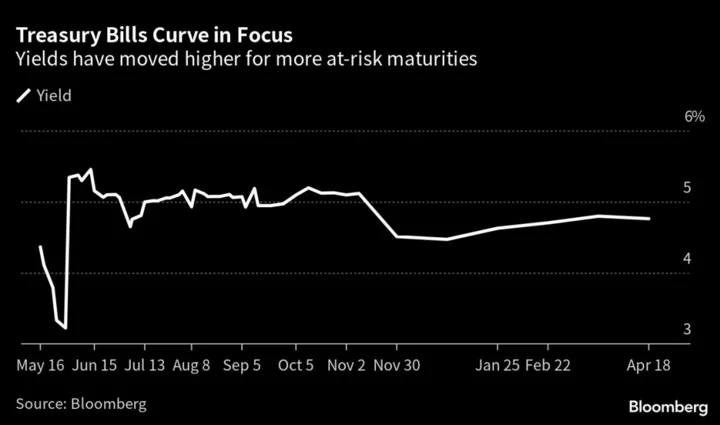

A technical failure by the US to meet its obligations would impact those Treasuries coming due most immediately. Bill markets are pricing in some risk of default in early June — echoing warnings from Treasury Secretary Janet Yellen that there’s a risk the government could run out of funds by then.

Credit default swaps — instruments that allow investors to insure against non-payment — are also pointing to heightened concern. Still both the Treasury and CDS market suggest a full-blown crisis remains a low-probability event, for now.

But that could change quickly if negotiations continue to sour. A default threatens to spur big moves around the globe, with the prospect of a major economic downturn and a reassessment of Fed monetary policy potentially igniting a perverse bid for Treasury bonds on haven demand.

Conversely, a resolution could shift the focus back to the outlook for inflation and the credit cycle for traders betting on whether the era of aggressive Fed interest-rate hikes has peaked.

Short-end interest rate markets are currently suggesting that the central bank is almost certainly done with tightening and that its next move will be a reduction, with a quarter-point cut from the current effective Fed Funds rate fully priced in as early as November.

“There are certain trades to have on regardless of the debt ceiling outcome and they would benefit if there was a technical default,” said Stephen Bartolini, a portfolio manager at T. Rowe Price. “The main position is a curve steepener, our base case is that the Fed is done and in the event of some kind of default, the Fed would be off the table” in terms of additional tightening.

This week’s face-to-face meeting between Biden and McCarthy, the first in months, produced little sign of movement, but negotiations between staffers are ongoing and the leaders are scheduled to meet again in the coming days.

Investors in stocks and bonds more broadly have remained relatively sanguine about the debt cap, even as fears around the banking sector and elevated interest rates have crimped the outlook somewhat.

Yet time is running out to bridge the gap between Republicans demanding spending cuts and Democrats, who want a clean increase to take default off the table before they engage in budget wrangling. Both sides have balked at the idea of doing a short-term fix to buy time, but that is something that might need to be revisited.

In the meantime, the drumbeat of warnings is growing louder. Yellen said this week that the federal government would have to renege on some payments if Congress doesn’t raise the debt limit, though no plan on how the department would proceed has yet been presented to Biden.

“What’s different this time from 2011 is that the political environment is much more contentious,” said T. Rowe Price’s Bartolini.

What to Watch

- Economic data calendar

- May 15: Empire manufacturing; Treasury International Capital flows

- May 16: Retail sales; New York Fed services business activity; industrial production, business inventories; NAHB housing market index

- May 17: MBA mortgages; housing starts and building permits

- May 18: Weekly jobless claims; Philadelphia Fed business outlook; existing home sales; leading index

- Federal Reserve calendar:

- May 15: Atlanta Fed’s Raphael Bostic, Minneapolis Fed’s Neel Kashkari, Governor Lisa Cook

- May 16: Cleveland Fed’s Loretta Mester, Fed Vice Chair for Supervision Michael Barr, New York Fed’s John Williams, Dallas Fed’s Lorie Logan, Bostic and Chicago Fed’s Austan Goolsbee

- May 18: Governor Philip Jefferson, Barr, Logan

- May 19: Chair Jerome Powell, Governor Michelle Bowman, Williams

- Auction calendar:

- May 15: 13-week and 26-week bills

- May 16: 52-week bills, 154-day cash management bill

- May 17: 17-week bills, 20-year bond

- May 18: 4-week and 8-week bills, 10-year Treasury inflation protected securities

--With assistance from Jonathan Ferro, Lisa Abramowicz, Tom Keene and Edward Bolingbroke.

Author: Benjamin Purvis, Michael Mackenzie and Ye Xie