The mood is rapidly souring in the world’s bond market, raising the stakes for Friday’s much-anticipated US monthly jobs data.

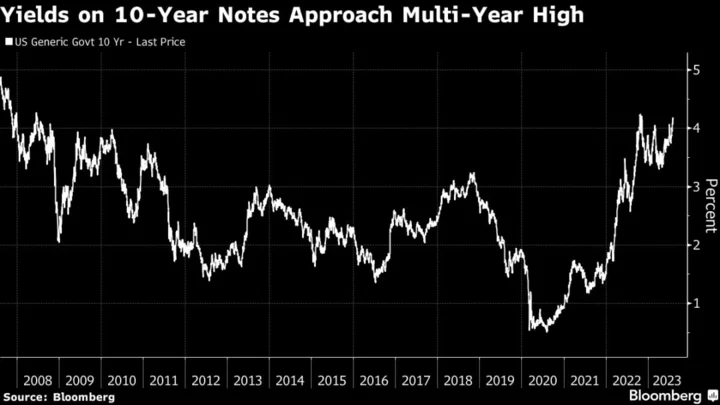

A surge in long-term yields to their highest since November has left the Treasury market close to shedding all its gains for 2023, crushing hopes for a rebound from last year’s record 12.5% loss. The move has spilled over to bond markets from Europe to Asia Pacific as traders pull back bets on the world’s biggest economy falling into recession.

One catalyst for the pain came Wednesday, with a stronger-than-forecast reading on US private sector jobs creation. The figures have an inconsistent track record when it comes to predicting what the government’s monthly figure will show. Still, they served to amp up the focus on Friday’s payrolls release, after Federal Reserve Chair Jerome Powell last month highlighted it as among the key data officials would watch as they decide whether to hike interest rates again in September.

“The Fed is data-dependent and the market wants to get through payrolls on Friday to understand if there is a risk that the policy rate is heading higher,” said George Catrambone, head of fixed income Americas at DWS. Further resilience in the labor market “means it’s hard to see the Fed thinking their job is done.”

A strong report, he said, will leave the market debating whether the Fed will tighten toward a peak of 6%, meaning potentially two more rate increases on top of the 5.25 percentage points of cumulative tightening the central bank has already delivered since March 2022.

The economy likely generated 200,000 non-farm jobs last month, which would be the weakest this year and down from 209,000 in June, according to a Bloomberg survey. Also of note, the report is forecast to show slowing growth in average hourly earnings.

“The key uncertainty is will wage growth pick up,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle. “If wages continue to slow this is a good set-up for the front end of the curve and the curve bull steepens.”

The 10-year Treasury yield has now eclipsed what traders dub a ‘double top’ — the 4.09% area where it topped out in March and July. That leaves market observers eying a path to even higher yields, in particular the October high of around 4.33%, a level last touched more than a decade ago.

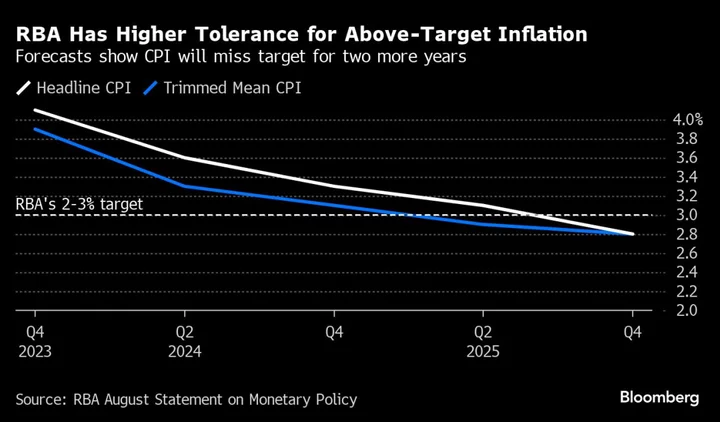

Benchmark yields in Australia and Germany are heading back toward their highs for the year, while Japan’s 10-year equivalent has hit the highest since 2014, triggering extra bond purchases from the country’s central bank to cap its rise.

For Michael Buchanan at Western Asset Management, such moments signal a buying opportunity.

“A soft landing is the story for next two to three quarters,” said the firm’s deputy chief investment officer. Western has had more duration exposure for the better part of the last two quarters and is “certainly willing to add on weakness,” he said.

--With assistance from Cormac Mullen.

(Updates with global context.)