Bank of England Governor Andrew Bailey dismissed claims by economists that Britain leaving the European Union has helped to fuel sticky inflation by worsening widespread worker shortages.

“I don’t think Brexit is a part of that labor market story,” he said on Wednesday on a panel at the European Central Bank Forum on Central Banking in Sintra, Portugal. “A lot of it, more of it is actually to do with, frankly, the response to Covid.”

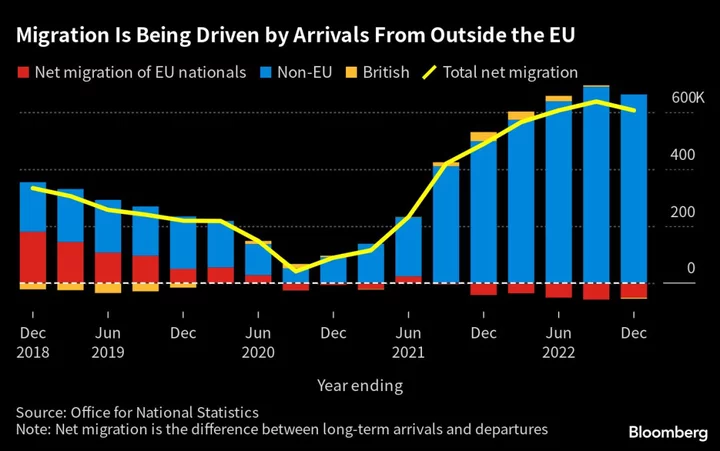

His remarks clash with research that suggests that the UK has lost out on workers after clamping down on EU immigration following Brexit. Migration flows, as well as a post-pandemic surge in long-term sickness, have been blamed for tightening the labor market, boosting pay and stoking fears of a wage-price spiral.

“We saw people come out of the labor force during the Covid period,” Bailey said. “Other countries have tended to see that that position reverse more quickly and more strongly than we’ve seen in the UK.”

Bailey also said that there are signs of persistence in recent inflation data and that core prices in the UK are much stickier. He added that the UK has a robust labor market with many firms hoarding labor amid recruitment difficulties.

A report by the Centre for European Reform and UK in a Changing Europe earlier this year found that Brexit has led to a shortfall of 330,00 workers in the jobs market by September 2022. Official data shows a sharp slowdown in EU immigration in recent years as the end of freedom of movement stops lower skilled workers entering the country.

The BOE has previously faced heavy criticism for its gloomy views on Brexit, particularly in the run-up to the EU referendum in 2016. It said in its February Monetary Policy Report that the blow to trade from Brexit is happening even sooner than it had initially feared.