The Biden administration is planning to step up the US government’s policing of an opaque market in biofuel compliance credits, following long-running complaints of wild price swings and manipulation.

The Environmental Protection Agency is set to lay out plans to collaborate more closely with the Commodity Futures Trading Commission and the Federal Trade Commission on the matter as part of a renewable fuel quota plan being unveiled Wednesday, according to a person familiar with the matter who asked not to be named before a formal announcement.

The EPA will commit to meet with the CFTC within 45 days to discuss potential daily monitoring of trading in the biofuel compliance credits, known as renewable identification numbers. And the agency will set a new volatility threshold for the price of those RINs, with the goal of identifying possible changes to the way they are generated and traded, the person said.

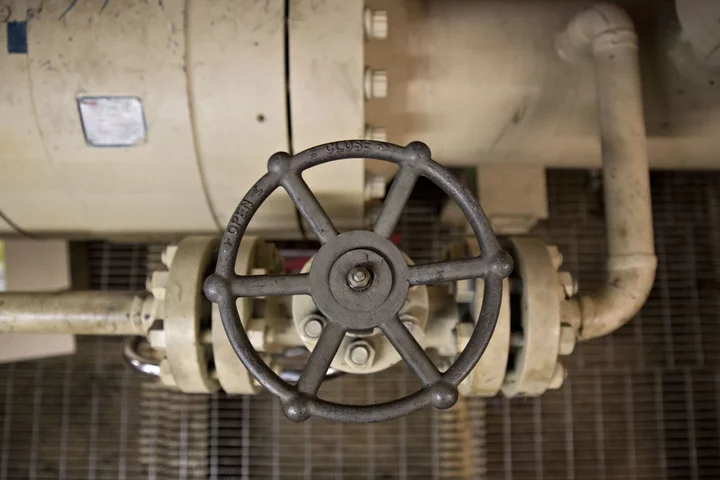

The moves mark the latest effort to address allegations of market manipulation and fraud around an 18-year-old mandate that compels refiners to blend corn-based ethanol, soy-based biodiesel and other renewable fuels into their products.

EPA spokespeople did not immediately respond to a request for comment late Tuesday night.

The government created RINs as a way to give fuel refiners and importers more flexibility in satisfying the targets — though the credits have morphed from a pure compliance tool to more of a financial commodity, with values that often swing in tandem with policy news from Washington.

Read More: The Fake Biofuel Factory That Pumped Out Real Money But No Fuel

Senators from the northeast US have pushed for an FTC investigation into possible RIN market manipulation. The EPA in 2019 also mandated public disclosure of some renewable fuel credit holdings, while stopping short of imposing position limits, outlawing trading by some parties and taking other recommended steps to crack down on RIN trades.

Seven years ago, the EPA and CFTC signed a memorandum of understanding to help guide collaboration and possible investigations into potential fraud, market abuse, or other violations relating to generation and trading of the RINs. The EPA now will consider revising the existing agreement to take advantage of additional agency expertise, including from the FTC.

Author: Jennifer Jacobs and Jennifer A. Dlouhy