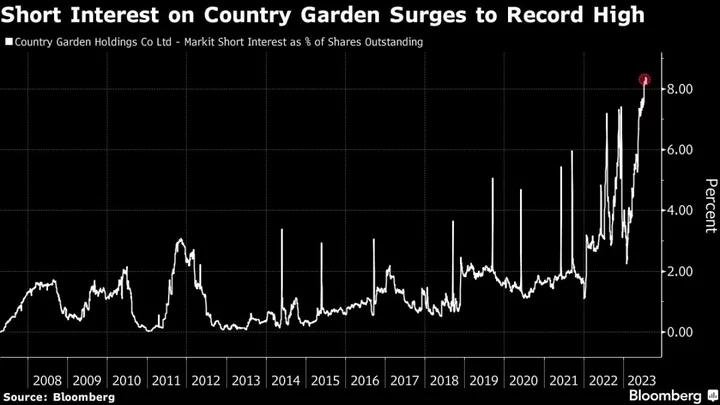

Short sellers are swarming over Country Garden Holdings Co. as the sixth-largest Chinese developer by sales faces increasing scrutiny of its operations amid a market slump.

Short interest as a percentage of shares outstanding has jumped to a record above 8%, while the company and its property management arm are the most-shorted members of the Hang Seng Index. Country Garden’s shares fell 2.3% on Tuesday to HK$1.29, dropping a fourth straight day.

Concern about whether Country Garden will be able to repay its dollar bonds due next year increased after the builder scrapped a share-sale plan last week, while analysts at firms from Moody’s Corp. to JPMorgan Chase & Co. have downgraded its bonds and stocks due to liquidity woes. Contracted sales slid 60% year-on-year to 12 billion yuan ($1.7 billion) last month, and analysts say the company’s relatively high exposure to lower-tier cities leaves it vulnerable to further trouble.

“It seems like more investors are betting on Country Garden’s liquidity concerns leading to its failure,” said Patrick Wong, a Bloomberg Intelligence analyst. The firm “has a sizable amount of projects, so any default will significantly affect the overall property market sentiment and hit other developers.”

One of its units wired cash to cover early repayment of a yuan bond, according to people familiar with the matter. All of the note’s holders chose to exercise the put option, and the issuer needs to remit 838 million yuan to repay the principal and interest.

Shares of the Foshan-based builder have slumped more than 50% this year, as investors become increasingly doubtful whether it can hold out as a rare survivor of the wave of defaults that has engulfed the sector since early 2021. The builder earlier said it expects to swing back to a net loss for the first half of this year.

(Updates with analyst’s comments, more background.)