By Ludwig Burger

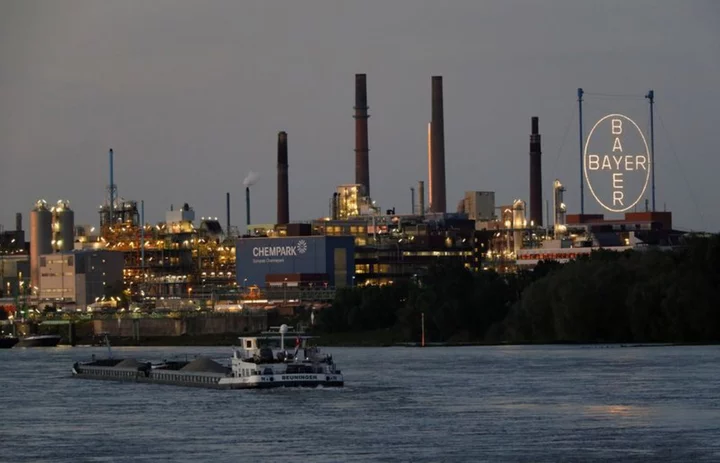

FRANKFURT (Reuters) -Bayer is considering spinning off its consumer health or crop science divisions, it said on Wednesday, as new CEO Bill Anderson gave his initial thoughts on how to revive the diversified German company's battered share price.

Management is looking into separating either the non-prescription medicines business or the agriculture business from the rest of the group which includes pharmaceuticals, but not at the same time, Bayer said in a statement.

A sequential split into three companies is also an option, as is keeping all three divisions, presentation slides showed.

"We are looking closely at our structural options. We have an expert team – including external financial advisors – evaluating them," Anderson said in the statement.

More details will be given at a capital markets day next March, the company said.

The German maker of medicines, seeds and crop chemicals also said it would remove several layers of management to accelerate decision-making, resulting in a "significant reduction" in the workforce. That confirmed a Reuters report from September.

"We are redesigning Bayer to focus only on what’s essential for our mission – and getting rid of everything else," said Anderson.

Bayer shares were flat at 0850 GMT, after rising as much as 1.2% in early trade.

"The statements around structural options for the company make it clear that the new CEO Bill Anderson is serious about it and will potentially follow through sooner rather than later," Deutsche Bank analysts said.

The company also expressed confidence in its full-year financial guidance but said a strong fourth quarter was needed.

The CEO, who joined from Swiss drugmaker Roche and took the helm in June, is under pressure to boost shares that have underperformed those of its peers, prompting investors to call for various forms of a break-up.

Anderson has previously said he would leave "no stone unturned" in his review of the 160-year-old German group and inventor of aspirin.

His appointment was widely welcomed by shareholders after predecessor Werner Baumann drew criticism for not responding to market concerns. But some investors have already urged Anderson to act quicker to address the continued share price slump.

Analysts have said Bayer shares are trading at a massive discount to rivals in agriculture, pharmaceuticals and consumer health activities, partly weighed down by a preference among many financial investors for pure-play companies.

U.S. lawsuits over the alleged carcinogenic effect of its commonly used Roundup weedkiller are another burden on the stock, which before Wednesday was down about 13% this year.

Bayer reported third-quarter earnings before interest, tax, depreciation and amortisation (EBITDA) and adjusted for one-off effects fell 31% to 1.685 billion euros, hit by lower earnings at its crop science division. That compared with analysts' average forecast of 1.725 billion euros.

It made a quarterly net loss of 4.57 billion euros against a profit of 546 million euros a year earlier, hit by impairment charges at the crop science unit due to higher interest rates.

Bayer added that it expects a "soft growth outlook and continued challenges" to profitability next year.

(Reporting by Ludwig BurgerEditing by David Goodman and Mark Potter)