Bangladesh is expected to propose raising taxes and boosting spending in its annual budget Thursday that will serve as a test of Prime Minister Sheikh Hasina’s prudent policymaking over populism ahead of elections due next year.

Trying to balance the budget is not a choice for Hasina, but a requirement from the International Monetary Fund, which in January approved $4.7 billion to the South Asian nation. The funds tied to conditions such as widening tax revenue, reforming the financial sector and removing subsidies couldn’t have come at a more delicate time for the 75-year-old leader — who faces elections that analysts and critics say she’s likely to win though discontentment over rising living costs remains a risk.

Hasina insisted last week that Bangladesh was in a position to pay back the IMF loan, saying the lender only gives assistance to countries that can repay their bill. Not all share that confidence.

Just days before Finance Minister AHM Mustafa Kamal’s budget presentation, Moody’s Investors Services cut Bangladesh’s credit rating deeper into junk territory, citing concerns of “heightened external vulnerability and liquidity risks” along with institutional weaknesses.

Here are issues and indicators to watch for in Thursday’s budget:

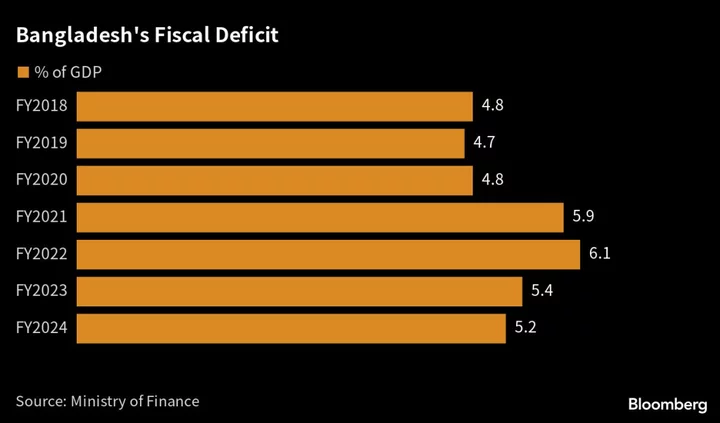

Fiscal Deficit

Bangladesh is expected to target a fiscal deficit of 5.2% of gross domestic product for the year starting July 1 — narrower than the current year’s shortfall that was originally pegged at 5.4% of GDP. Moody’s expects the fiscal deficit to remain around 5%-5.5% over the next few years.

Tax Targets

Under the IMF program, Bangladesh has to raise the revenue-to-GDP ratio by 1.5 percentage points by the 2025-26 fiscal year to boost spending on social, development and climate projects.

The Washington-based lender also set a goal for the nation’s tax revenue to rise to 3.46 trillion taka ($32 billion) by June. However, the government has managed a collection of only 2.47 trillion taka in the 10 months through April.

Subsidy Cuts

Subsidy cuts are a major requirement for the IMF program and the budget could provide more hints. Subsidies accounted for 12.2%, or 827.45 billion taka of this year’s budget and usually cover electricity, food and agriculture.

The government has already hiked electricity prices three times this year and Hasina has said there’s more to come.

Inflation Path

Consumer prices rose 9.24% in April, surpassing the government’s target 5.6% for this fiscal year and making the case for Kamal to set a higher estimate of 6.5% for the new year.

While the new target takes into account the gradual removal of subsidies, higher inflation could well become a political headache for Hasina and her government. The largest opposition group, the Bangladesh Nationalist Party, continued street protests for months over the soaring costs of living, blaming it on the government’s economic mismanagement and demanding that Hasina step down to make way for a caretaker government.

Growth Goals

The budget will seek a path for the economy to expand by 7.5% next fiscal year, and eventually graduate from being a least developed country in 2026.

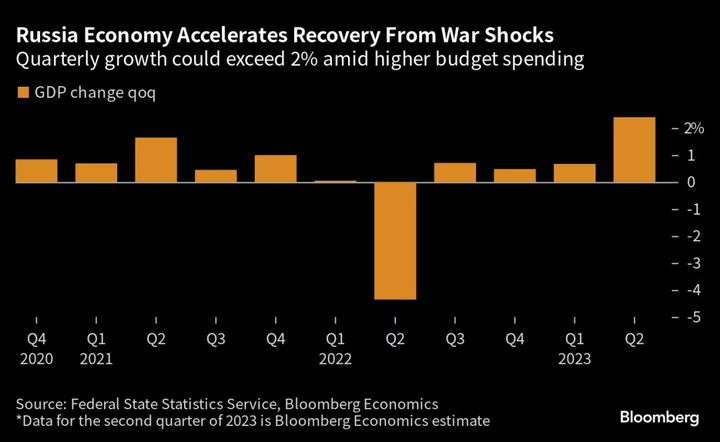

The government had initially targeted that pace of growth this year, but pared it to 6.5% as Russia’s prolonged war in Ukraine raised food and fuel costs and weakened the global economy.

--With assistance from Eltaf Najafizada.