Australia’s consumer confidence stabilized at “near recession lows” as a significant rise in the minimum wage offset the Reserve Bank unexpectedly raising interest rates for a second straight month.

Sentiment advanced 0.2% to 79.2 points in June, a Westpac Banking Corp. survey showed Tuesday. The poll was conducted June 5-9 and Westpac said responses were overwhelmingly optimistic ahead of the June 6 rate rise, then slumped in the days after the decision.

“For the last year the index has held around levels we have not seen on a sustained basis since the deep recession of the late 1980s/early 1990s,” said Bill Evans, chief economist at Westpac. “Confidence in the labor market, the one consistent positive, has now turned.”

The survey came just after the Fair Work Commission increased the minimum wage by 5.75% and included a speech by Governor Philip Lowe where he said persistent inflationary pressures were testing policy makers’ patience. The RBA chief flagged upside risks to consumer prices and warned that further rate rises “may be required.”

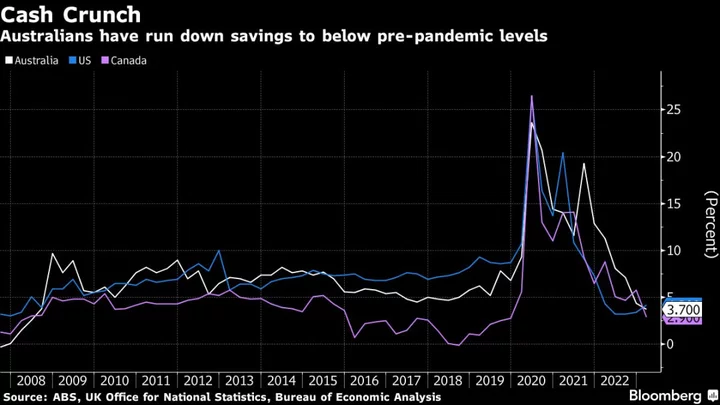

The report showed assessments of “finances compared to a year ago” were weaker among consumers with a mortgage, even as the overall index rose. Many Australian households are being squeezed by rising loan repayments and still elevated inflation.

The “family finances next 12 months” sub-index declined 2.1% to 84, while the “economic outlook, next 12 months” sub-index was essentially unchanged at a very weak 77.2, Westpac said.

A gauge of the outlook for household spending, “the time to buy a major household item” sub-index fell 6.5% to just 76.4. Buyer sentiment is extremely weak across the mortgage belt, among women and those aged over 45, according to Westpac.

“Of most concern is confidence around jobs – which has been the single bright spot in otherwise bleak consumer surveys over the last year,” Evans said. “This now looks to be fading fast.” The Westpac-Melbourne Institute Unemployment Expectations Index rose 6.6% in June to 131.3 — a higher reading means more consumers expect unemployment to rise in the year ahead.

Australia’s property market persisted in defying gravity, having rebounded despite the RBA raising rates by 4 percentage points in 14 months.

“Expectations for house prices remained firmly positive. Indeed, there was no significant change in the index in the samples before and after the rate increase decision was announced,” Evans said.