Australia’s central bank said the case to leave interest rates unchanged this month was the “stronger one” following a series of line-ball decisions as policymakers focused on the long lags of transmission and the risk of a sharper economic downturn.

The Reserve Bank’s board debated raising the cash rate for a third straight month but decided to stand pat at 4.1%, minutes of the July 4 meeting showed Tuesday. The decision came amid concerns the 4 percentage points of cumulative hikes over the past year are already beginning to hurt the economy.

“The board recognized the strength of both sets of arguments but judged the case to hold the cash rate unchanged at this meeting was the stronger one,” the minutes showed. “Noting both the uncertainty around the outlook and the significant increase in interest rates to date, members agreed to hold the cash rate steady and reassess the situation at the August meeting.”

Rates traders stuck with pricing a 40% chance for a hike in August and trimmed their bets on a September increase, overnight-indexed swaps show. The currency and Australian government bond yields barely moved following the release.

The RBA left the door ajar for further hikes to help bring inflation back to target “within a reasonable timeframe.” Next month, the bank will have second-quarter inflation data and updated economic forecasts available, which will help the board make up its mind on whether another hike is needed to cool inflation, the RBA said.

“The minutes place a lot of emphasis on the release of Q2 CPI data,” said Tony Sycamore, markets analyst at IG. “If the headline comes in at 6.4% or higher, it’s likely game on again in August.”

Among reasons to pause, board members highlighted that monetary policy has already been tightened “considerably and rapidly over the prior year” and the current level of the cash rate is “clearly restrictive.” The rate is currently the highest since April 2012.

Other factors included:

- Mortgage interest payments as a share of household disposable income were around a record high in May and would rise further as fixed-rate loans continued to mature

- Inflation is now declining, helping mitigate the risk of a rise in medium-term inflation expectations

- Risk that output growth slows by more than expected

- Considerable uncertainty about the resilience of household consumption

- Higher interest rates could encourage households to save more, hurting consumption and if that were to occur the demand for labor would loosen

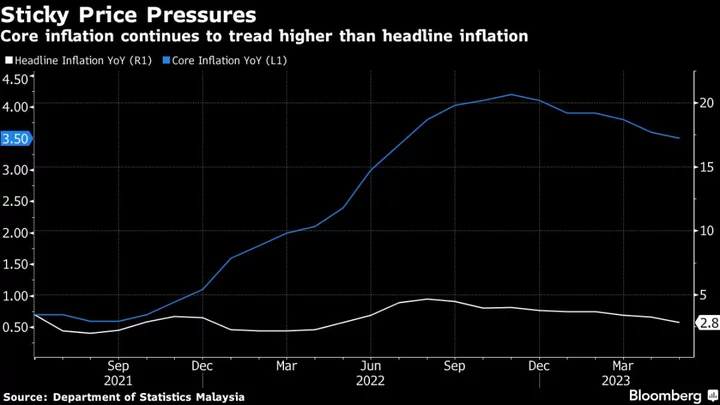

On the flip side, the case to increase rates further was centered on the observation that inflation was forecast to remain above the RBA’s 2-3% target band until mid-2025 and “there was a risk that this timeframe would be extended without further monetary policy tightening.”

Several CPI categories for which inflation was typically quite persistent already had too high price growth, including rent and services, the minutes showed.

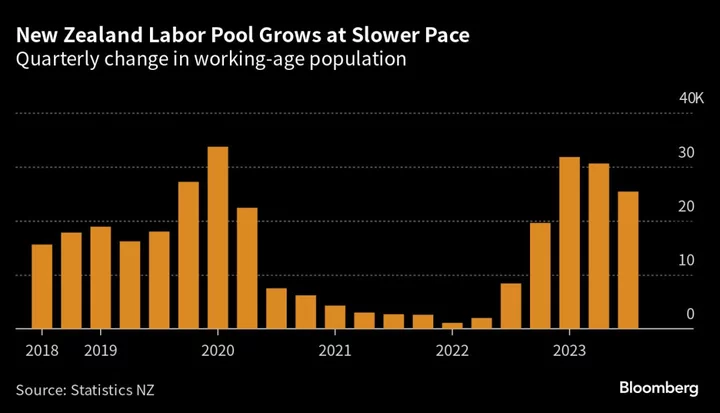

Members also observed that weak productivity was contributing to strong growth in unit labor costs. The jobs market remained very tight with the unemployment rate at 3.6%. In addition, inflation in advanced economies was proving more persistent than expected, prompting unexpected or larger-than-forecast rate hikes elsewhere.

Australia has lagged global counterparts in its policy response to higher prices, having raised rates by 4 percentage points since May 2022, compared with New Zealand’s 5.25 points and 5 points by the US. Economists still expect two more rate hikes by the RBA later this year while financial markets are fully pricing in only one more increase to 4.35%.

Data last week painted a mixed picture of the economy with Australia’s business conditions showing ongoing resilience though consumer confidence remained in “deeply pessimistic” territory.

Later this week, employment data will provide further clues on the health of Australia’s labor market with economists predicting the jobless rate will remain steady at 3.6% even after 12 rate hikes.

“We still think it’s too soon to call the end of the RBA’s tightening cycle,”said Abhijit Surya, economist at Capital Economics. “There remain several upside risks to the inflation outlook.”

(Adds market reaction, analyst comment.)