Asian shares face headwinds Monday after the rally in US bonds and stocks hit a wall Friday amid concern that the Federal Reserve can’t claim victory over inflation yet.

Equity futures for Australia were little changed while those for Hong Kong dropped 0.7% and an index of US-listed Chinese stocks fell more than 2%. Japanese markets will be closed for a holiday.

China’s central bank is expected to keep its medium-term lending facility unchanged as authorities continue to under-deliver on market calls for more stimulus. Traders will also be parsing gross domestic product figures that will be muddied by the base effects of Shanghai’s lockdown last year. Bloomberg Economics sees GDP growth slowing after “cutting through the statistical noise.”

Contracts for the S&P 500 and Nasdaq 100 were marginally lower as trading got underway in Asia on Monday. The underlying indexes posted mild losses Friday as traders cited consolidation after an advance that still drove the S&P 500 to its best week since mid-June.

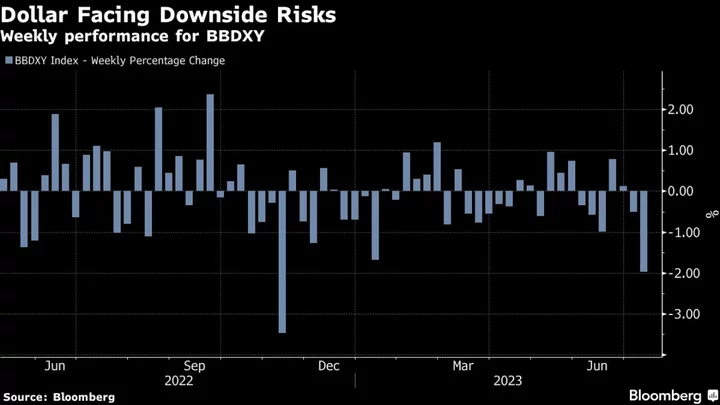

The dollar was mixed and within tight ranges after a gauge of greenback strength snapped a five-day losing streak Friday. Its weekly slide has the index back near levels last seen in April 2022 as some strategists and investors suggest its long bull run is over.

The yen was steady after Bank of Japan Governor Kazuo Ueda said uncertainty remains high over the US and global economies. He also said the at the end of a Group-of-Seven meeting that there was not much change in Japan’s bond-market functionality from the last monetary policy meeting in June.

In the US bond market on Friday, Treasuries reacted immediately to a report showing consumer sentiment soared to an almost two-year high — while short-term price expectations rose. The front-end of the yield curve took the brunt of the selling, with the rate on two-year Treasuries rising by 14 basis points. That was a stark contrast to the slide in rates over the preceding few days.

“We think it is premature to declare victory on inflation and expect volatility to remain elevated over the near term,” JPMorgan Chase & Co. strategists led by Phoebe White wrote in a note, even after other data last week “revived the market narrative surrounding immaculate disinflation and a soft landing.”

Fed officials continued to sound cautious.

Late Thursday, Governor Christopher Waller said he expected two more rate increases this year to bring inflation down to the 2% goal, though more good data on prices could obviate the need for the second hike.

Swaps pricing show expectations that the Fed is virtually certain to raise its benchmark rate by another 25 basis points when it meets later this month, with a roughly one-third chance that the central bank will make one more such move before stopping its cycle.

Investors also sifted through results from JPMorgan, Wells Fargo & Co. and Citigroup Inc., which easily beat lowered analyst estimates. UnitedHealth Group Inc. surged as profits allayed fears of runaway medical costs.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 7:26 a.m. Tokyo time. The S&P 500 fell 0.1% Friday

- Nasdaq 100 futures were little changed. The Nasdaq 100 was little changed Friday

- Australia’s S&P/ASX 200 Index was little changed

- Hang Seng Index futures fell 0.7%

Currencies

- The euro was little changed at $1.1227

- The Japanese yen was little changed at 138.75 per dollar

- The offshore yuan was little changed at 7.1583 per dollar

- The Australian dollar was little changed at $0.6834

Cryptocurrencies

- Bitcoin rose 0.2% to $30,355.29

- Ether rose 0.3% to $1,935.94

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 3.83% on Friday

Commodities

- West Texas Intermediate crude fell 0.9% to $74.75 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.