Asian stocks look poised to follow US equities with modest gains Monday after Jerome Powell said the Federal Reserve would “proceed carefully” on whether to raise interest rates again, while signaling policy will remain tighter for longer.

Most major currencies were little changed in early Asian trading, with the yen steadying after sliding to its weakest this year on Friday after the Fed chief’s remarks. Bank of Japan Governor Kazuo Ueda didn’t comment on foreign-exchange rates but said price growth remains slower than the central bank’s goal.

The euro was unchanged and largely resistant to European Central Bank President Christine Lagarde’s vow to set borrowing costs as high as needed and leave them there until inflation is in check. The yuan will remain in focus amid China’s campaign to prop-up the currency.

Equity futures for Japan, Hong Kong and Australia all pointed to small gains of less than 1% following the S&P 500’s 0.7% advance Friday, when it capped its best week since July. US equity futures opened higher Monday.

Investors in Chinese equities have countervailing forces to weigh, with data on Sunday showing a decline in industrial profits eased while deflation risks remain an overhang. China also announced measures to support the equities market, lowering the stamp duty on stock trades for the first time since 2008 and pledging to slow the pace of initial public offerings.

While Treasuries were little changed during Powell’s long-awaited speech in Jackson Hole, Wyoming, yields pushed up after it concluded as the longer-for-higher rates message appeared to sink in. The yield on two-year bonds, which are highly sensitive to the Fed’s policy shifts, are comfortably above 5% while the rate on 10-year Treasuries fluctuated near 4.2%.

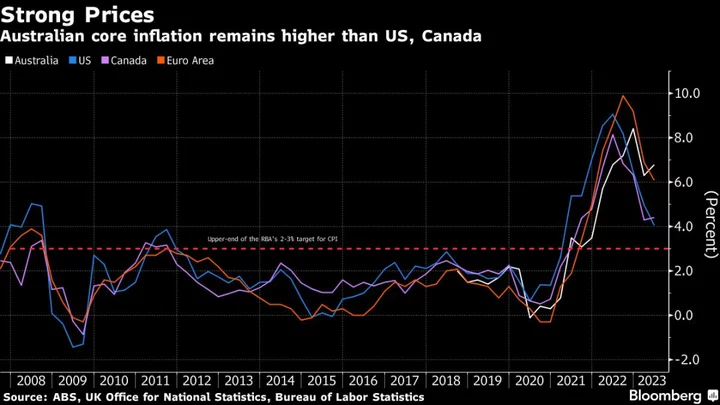

Powell cautioned that the process of bringing inflation back to its target “still has a long way to go.” He also suggested officials could hold rates steady in September, as investors expect.

“Powell, as has been the case for some time, didn’t offer markets anything revelatory,” said Tom Garretson, senior portfolio strategist at RBC Wealth Management. “The market reaction looks consistent with the idea that the Fed is likely done raising rates over the near term, but still stands more than ready to do more if economic data dictates it.”

Fed Bank of Philadelphia President Patrick Harker signaled he favored holding rates at current levels to allow the effects of cumulative tightening to work through the system. His Cleveland counterpart Loretta Mester noted that undertightening interest rates would be “a worse mistake” than raising them too much. Fed Bank of Chicago head Austan Goolsbee said the Fed is part of the way down the road to a soft landing.

“No alarms and no surprises,” said Michael Feroli, Chase & Co.’s chief US economist. After these remarks we still think the Fed is on extended hold, though with a risk they hike next month if the data between now and Sept. 20 come in hot.”

Key events this week:

- US Conference Board consumer confidence, Tuesday

- Eurozone economic confidence, consumer confidence, Wednesday

- US GDP, wholesale inventories, pending home sales, Wednesday

- China manufacturing PMI, non-manufacturing PMI, Thursday

- Japan industrial production, retail sales, Thursday

- Eurozone CPI, unemployment, Thursday

- ECB publishes account of July monetary policy meeting, Thursday

- US personal spending and income, initial jobless claims, Thursday

- China Caixin manufacturing PMI, Friday

- Eurozone S&P Global Eurozone Manufacturing PMI, Friday

- South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

- Boston Fed President Susan Collins speaks at virtual event, Friday.

- US unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 7:01 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 rose 0.85%

- Nikkei 225 futures rose 0.7%

- Australia’s S&P/ASX 200 Index futures rose 0.3%

- Hang Seng Index futures rose 0.1%

Currencies

- The euro was little changed at $1.0798

- The Japanese yen was little changed at 146.43 per dollar

- The offshore yuan rose 0.1% to 7.2860 per dollar

- The Australian dollar rose 0.1% to $0.6411

Cryptocurrencies

- Bitcoin was little changed at $26,059.32

- Ether was little changed at $1,652.91

Bonds

- The yield on 10-year Treasuries was little changed at 4.24%

Commodities

- West Texas Intermediate crude rose 0.5% to $80.19 a barrel

- Spot gold fell 0.1% to $1,914.96 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.