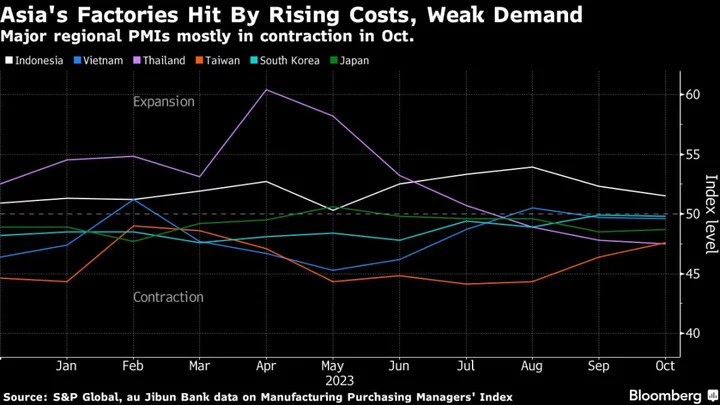

Manufacturing activity in Asia slumped again in October as conflict in the Middle East drove oil prices higher, costs rose and global demand remained under pressure.

Most countries across the region reported pressures from cost inflation, shrinking output and new orders, according to manufacturing purchasing managers’ indexes published Wednesday by S&P Global and au Jibun Bank. A private gauge of factory activity in China unexpectedly contracted, underlining fragility within the world’s second-largest economy.

The data are a discouraging sign for the global economy, which has seen its bid for recovery threatened by uncertainty over the Israel-Hamas war and the prospect of wider conflict in the region. Asia — which makes much of the world’s goods — has struggled to ramp up production this year amid patchy demand from major markets including the US and Europe.

PMI readings for Japan and South Korea remained mired in contraction at 48.7 and 49.8, respectively, little changed from the prior month. A reading above 50 indicates an expansion in activity, while anything below suggests contraction.

“The rate of inflation was robust and the strongest seen in the year to date amid reports of higher raw material prices, notably those linked to oil,” said Usamah Bhatti, economist at S&P Global Market Intelligence, in a statement accompanying the South Korean data. Bhatti also noted that firms had mentioned unfavorable exchange rates as their currencies came under pressure, leading to higher input costs.

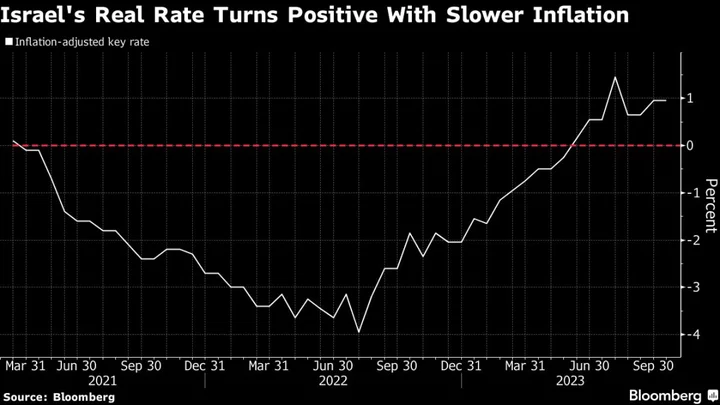

While oil prices are beginning to cool again, war in the Middle East led to volatility over the month — just as many Asian factories had begun to enjoy cooling inflation and widening profit margins. Crude costs may surge further this quarter if a broader conflict erupts. Elevated interest rates — or ones that climb even higher — would crimp any plans to expand manufacturing activity.

Most of Southeast Asia — which has typically been able to rely on the strength of its domestic markets to power growth — was in contraction in October. PMIs for Vietnam, Myanmar and Thailand deteriorated, while Malaysia was unchanged. Only Indonesia managed to expand in October from the prior month, though the rate of growth was slower.

The stop-start recovery is also evident in China, where the private Caixin survey of manufacturing activity fell to 49.5 in October from 50.6 the month before. That mirrored an official gauge this week that also showed factory activity shrank in October given the stretch of public holidays in the month along with muted market demand.

“Manufacturers were not in high spirits in October,” said Wang Zhe, senior economist at Caixin Insight Group, in a statement accompanying the Caixin data that cited falling supply, employment and external demand. “The economy has showed signs of bottoming out, but the foundation of recovery is not solid.”

What Bloomberg Economics Says ...

“China’s October Caixin manufacturing survey hammered home the message that growth momentum is softening despite proactive policy support — in line with the signal from the official PMI. The surprise decline in the PMI deepens our concerns over prospects for small, export-oriented companies — and the strength and durability of the recovery more broadly.”

— Chang Shu and Eric Zhu, economists

Read the full report here.

There have been a couple of signs that the worst may be over for at least some parts of the region as activity and demand attempt to recover.

Trade bellwether Taiwan — which has seen PMI contract for more than a year — recorded a reading of 47.6 in October. The best reading in seven months suggested that the decline in activity in the economy is becoming less severe.

South Korea, meanwhile, posted an increase in exports of 5.1% in October from a year earlier— the first rise since late last year and an indication that there is some resilience in global demand. Manufacturers also reported improved business optimism over the coming 12 months, saying in the PMI survey that resurgent demand would stimulate new product launches and sales.

--With assistance from Fran Wang and Jasmine Ng.

(Updates with China Caixin PMI, South Korea exports.)