A former Bank of England policy maker who has criticized officials for failing to rein in inflation more quickly said investors are “jumping the gun” by anticipating the key rate will soar to 6%.

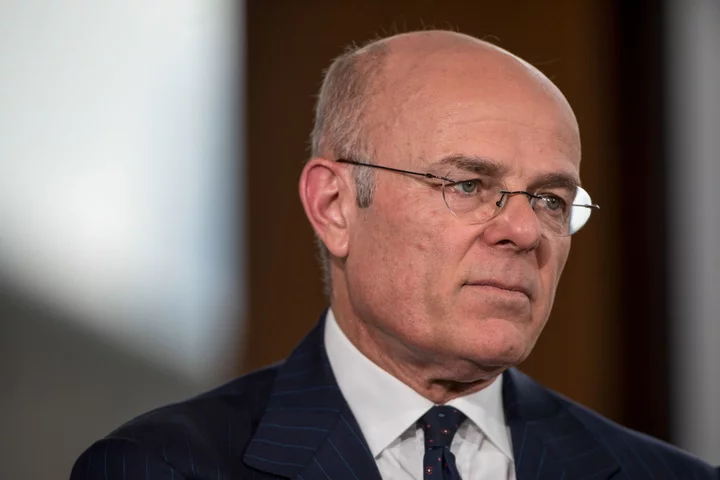

Andrew Sentance, who served on the UK central bank’s rate-setting committee through the global financial crisis, said further hikes will depend on economic data that may not justify such forceful hikes.

“I would certainly expect interest rates to go up a little bit more,” Sentance said in an interview on Bloomberg radio Friday. “But whether they go up as high as 6% I think is going to depend very much on the economic data.”

The remarks, from an economist who has advocated tighter monetary policy for years, introduce doubt into market bets for a full percentage point of additional increases in the BOE’s key lending rate. Officials boosted rates by a half point Thursday to 5%, a surprise move that brought borrowing costs to the highest since 2008.

“We could find that the recent flow of data has been due to sort of special factors and if the downward trend and inflation and then core inflation and the wages and in service sector inflation begins to assert itself,” Sentance said. “Then that will be positive news for the MPC.”

Now a senior adviser to Cambridge Econometrics, Sentance said the Monetary Policy Committee made a series of “crucial” errors, including the period of low interest rates in the 2000s, maintaining their quantitative easing program for too long and not increasing interest rates quickly enough in 2022.

“Much of the criticism is justified,” Sentance said. “All the MPC members need to look at their record and perhaps take stock of what they’ve really taken the challenge of rising inflation seriously enough.”

--With assistance from Stephen Carroll.